Page 2

41A720FD (06-15)

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

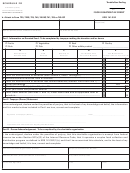

INSTRUCTIONS—SCHEDULE FD

PURPOSE OF SCHEDULE—This schedule is used

identifying the price received by the donor for the

by a taxpayer (donor) who provides free of fee or

edible agriculture products of comparable grade and

charge edible agriculture products to a nonprofit food

quality; or (ii) If there is no previous sale to a buyer,

program operating in Kentucky as provided by KRS

the donor shall on the date of the donation, determine

141.392.

the value of the donated edible agriculture products

based on the fair market value as determined by

For taxable years beginning on or after January 1,

average weekly regional produce auction prices or

2014, but before January 1, 2018, any donor shall

United States Department of Agriculture prices for

be allowed a nonrefundable credit (food donation

meat, fish and dairy products.

tax credit) against the tax imposed by KRS 141.020

or 141.040 and 141.0401, with the ordering of credits

Line 7—Add Lines 1 through 6.

as provided by KRS 141.0205, in the amount equal to

ten percent (10%) of the value of the donated edible

Line 8—Reimbursements received from all sources,

agricultural products. A qualified taxpayer claiming

such as any reimbursed costs of picking or transporting

the food donation tax credit shall attach this schedule

the donated food.

to the applicable tax return.

Line 9—Subtract Line 8 from Line 7.

A qualified taxpayer that is a pass-through entity

not subject to the tax imposed by KRS 141.040 shall

Line 11—Multiply Line 9 by Line 10.

apply the food donation tax credit against the limited

liability entity tax imposed by KRS 141.0401, and shall

Line 12—Enter the prior year carryforward amount.

distribute the amount of the approved tax credit to

each partner, member or shareholder based on the

Line 13—Add Lines 11 and 12. Enter the amount on this

partner’s, member’s or shareholder’s distributive

line and the applicable tax form or schedule. In order

share of income as determined for the taxable year

to claim the credit, this schedule must be attached to

during which the tax credit is approved, with the

the applicable tax return.

ordering of credits as provided by KRS 141.0205.

Part II – Taxpayer (Donor) Statement

A tax credit not used by a qualified taxpayer in the

current taxable year may be carried forward for up to

The taxpayer (donor) or the representative of the

four (4) succeeding years.

taxpayer shall certify that the information and fair

market values included in Part I are true, correct and

GENERAL INSTRUCTIONS

complete. Enter the date signed, and type the name

and title of person signing this document in the spaces

Part I – Information on Donated Food

provided. Failure to sign the schedule or to provide all

information may result in the disallowance of the tax

Check the box that best describes the donated food. If

credit.

the box for “Other edible product” is checked, describe

the product in the space provided.

Part III – Donee Acknowledgement

Lines 1 through 6—Enter the following: Column A, the

The representative of the charitable organization

description of the item of food being donated; Column

(donee) shall certify that the charitable organization

B, the date donated; Column C, the quantity of the

is exempt from federal income tax under Section

food item; Column D, the fair market price of each unit

501(c)(3) of the Internal Revenue Code, certify that it

of measure; and Colum E, the total fair market value.

operates a surplus food collection and distribution

program as defined in KRS 141.392(1)(c), and certify

Attach a separate schedule if more than 6 items are

that the information included in the schedule is true,

being donated.

correct and complete. Enter the name, Employer

Identification Number, and address of the charitable

KRS 141.392(3)(b) provides that a donor shall

organization in the spaces provided. Also, enter the

determine the value of the donated edible agriculture

title of person signing this document and the date in

products as follows: (i) if there was a previous sale of

the spaces provided. Failure to sign the schedule or to

the edible agriculture products to a buyer, the donor

provide all information may result in the disallowance

shall retain a copy of an invoice or other statement

of the tax credit.

1

1 2

2