Form Ar1000a Instructions - Amended Individual Income Tax Return - Arkansas Department Of Revenue

ADVERTISEMENT

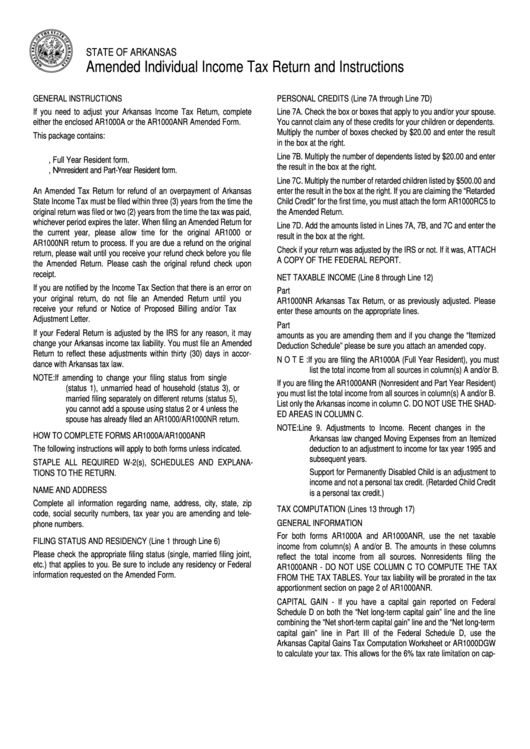

STATE OF ARKANSAS

Amended Individual Income Tax Return and Instructions

GENERAL INSTRUCTIONS

PERSONAL CREDITS (Line 7A through Line 7D)

If you need to adjust your Arkansas Income Tax Return, complete

Line 7A. Check the box or boxes that apply to you and/or your spouse.

either the enclosed AR1000A or the AR1000ANR Amended Form.

You cannot claim any of these credits for your children or dependents.

Multiply the number of boxes checked by $20.00 and enter the result

This package contains:

in the box at the right.

1.

Instructions to complete form AR1000A and AR1000ANR.

Line 7B. Multiply the number of dependents listed by $20.00 and enter

2.

Form AR1000A, Full Year Resident form.

the result in the box at the right.

3.

Form AR1000ANR, Nonresident and Part-Year Resident form.

4.

Tax Tables.

Line 7C. Multiply the number of retarded children listed by $500.00 and

An Amended Tax Return for refund of an overpayment of Arkansas

enter the result in the box at the right. If you are claiming the “Retarded

State Income Tax must be filed within three (3) years from the time the

Child Credit” for the first time, you must attach the form AR1000RC5 to

original return was filed or two (2) years from the time the tax was paid,

the Amended Return.

whichever period expires the later. When filing an Amended Return for

Line 7D. Add the amounts listed in Lines 7A, 7B, and 7C and enter the

the current year, please allow time for the original AR1000 or

result in the box at the right.

AR1000NR return to process. If you are due a refund on the original

Check if your return was adjusted by the IRS or not. If it was, ATTACH

return, please wait until you receive your refund check before you file

A COPY OF THE FEDERAL REPORT.

the Amended Return. Please cash the original refund check upon

receipt.

NET TAXABLE INCOME (Line 8 through Line 12)

If you are notified by the Income Tax Section that there is an error on

Part 1. Report the information you originally filed on your AR1000 or

your original return, do not file an Amended Return until you

AR1000NR Arkansas Tax Return, or as previously adjusted. Please

receive your refund or Notice of Proposed Billing and/or Tax

enter these amounts on the appropriate lines.

Adjustment Letter.

Part 2. Report the information that is being adjusted. Enter the

If your Federal Return is adjusted by the IRS for any reason, it may

amounts as you are amending them and if you change the “Itemized

change your Arkansas income tax liability. You must file an Amended

Deduction Schedule” please be sure you attach an amended copy.

Return to reflect these adjustments within thirty (30) days in accor-

N O T E :

If you are filing the AR1000A (Full Year Resident), you must

dance with Arkansas tax law.

list the total income from all sources in column(s) A and/or B.

NOTE:

If amending to change your filing status from single

If you are filing the AR1000ANR (Nonresident and Part Year Resident)

(status 1), unmarried head of household (status 3), or

you must list the total income from all sources in column(s) A and/or B.

married filing separately on different returns (status 5),

List only the Arkansas income in column C. DO NOT USE THE SHAD-

you cannot add a spouse using status 2 or 4 unless the

ED AREAS IN COLUMN C.

spouse has already filed an AR1000/AR1000NR return.

NOTE:

Line 9. Adjustments to Income. Recent changes in the

HOW TO COMPLETE FORMS AR1000A/AR1000ANR

Arkansas law changed Moving Expenses from an Itemized

The following instructions will apply to both forms unless indicated.

deduction to an adjustment to income for tax year 1995 and

subsequent years.

STAPLE ALL REQUIRED W-2(s), SCHEDULES AND EXPLANA-

Support for Permanently Disabled Child is an adjustment to

TIONS TO THE RETURN.

income and not a personal tax credit. (Retarded Child Credit

NAME AND ADDRESS

is a personal tax credit.)

Complete all information regarding name, address, city, state, zip

TAX COMPUTATION (Lines 13 through 17)

code, social security numbers, tax year you are amending and tele-

GENERAL INFORMATION

phone numbers.

For both forms AR1000A and AR1000ANR, use the net taxable

FILING STATUS AND RESIDENCY (Line 1 through Line 6)

income from column(s) A and/or B. The amounts in these columns

Please check the appropriate filing status (single, married filing joint,

reflect the total income from all sources. Nonresidents filing the

etc.) that applies to you. Be sure to include any residency or Federal

AR1000ANR - DO NOT USE COLUMN C TO COMPUTE THE TAX

information requested on the Amended Form.

FROM THE TAX TABLES. Your tax liability will be prorated in the tax

apportionment section on page 2 of AR1000ANR.

CAPITAL GAIN - If you have a capital gain reported on Federal

Schedule D on both the “Net long-term capital gain” line and the line

combining the “Net short-term capital gain” line and the “Net long-term

capital gain” line in Part III of the Federal Schedule D, use the

Arkansas Capital Gains Tax Computation Worksheet or AR1000DGW

to calculate your tax. This allows for the 6% tax rate limitation on cap-

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2