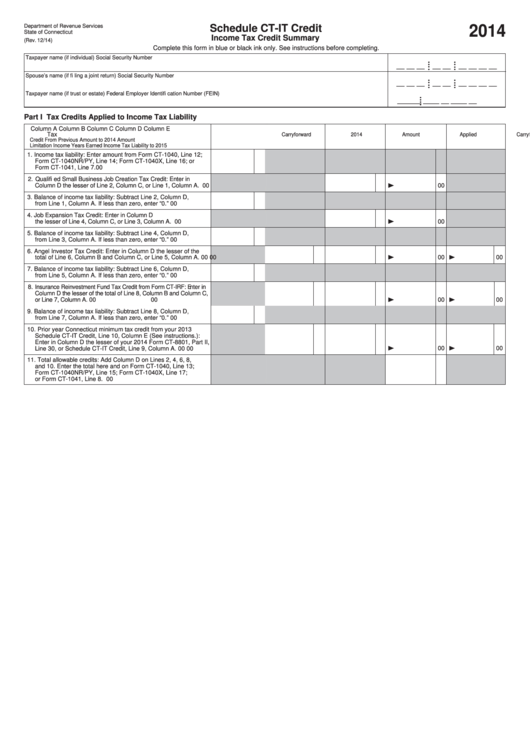

Schedule Ct-It Credit - Income Tax Credit Summary - Connecticut Department Of Revenue - 2014

ADVERTISEMENT

Department of Revenue Services

Schedule CT-IT Credit

2014

State of Connecticut

Income Tax Credit Summary

(Rev. 12/14)

Complete this form in blue or black ink only. See instructions before completing.

Taxpayer name (if individual)

Social Security Number

•

•

__ __ __ __ __ __ __ __ __

• •

•

• •

•

Spouse’s name (if fi ling a joint return)

Social Security Number

•

• •

__ __ __ __ __ __ __ __ __

•

• •

•

•

Taxpayer name (if trust or estate)

Federal Employer Identifi cation Number (FEIN)

•

__ __ __ __ __ __ __ __ __

• •

•

Part I Tax Credits Applied to Income Tax Liability

Column A

Column B

Column C

Column D

Column E

Tax

Carryforward

2014

Amount Applied

Carryforward

Credit

From Previous

Amount

to 2014

Amount

Limitation

Income Years

Earned

Income Tax Liability

to 2015

1. Income tax liability: Enter amount from Form CT-1040, Line 12;

Form CT-1040NR/PY, Line 14; Form CT-1040X, Line 16; or

Form CT-1041, Line 7.

00

2. Qualifi ed Small Business Job Creation Tax Credit: Enter in

Column D the lesser of Line 2, Column C, or Line 1, Column A.

00

00

3. Balance of income tax liability: Subtract Line 2, Column D,

from Line 1, Column A. If less than zero, enter “0.”

00

4. Job Expansion Tax Credit: Enter in Column D

the lesser of Line 4, Column C, or Line 3, Column A.

00

00

5. Balance of income tax liability: Subtract Line 4, Column D,

from Line 3, Column A. If less than zero, enter “0.”

00

6. Angel Investor Tax Credit: Enter in Column D the lesser of the

total of Line 6, Column B and Column C, or Line 5, Column A.

00

00

00

00

7. Balance of income tax liability: Subtract Line 6, Column D,

from Line 5, Column A. If less than zero, enter “0.”

00

8. Insurance Reinvestment Fund Tax Credit from Form CT-IRF: Enter in

Column D the lesser of the total of Line 8, Column B and Column C,

or Line 7, Column A.

00

00

00

00

9. Balance of income tax liability: Subtract Line 8, Column D,

from Line 7, Column A. If less than zero, enter “0.”

00

10. Prior year Connecticut minimum tax credit from your 2013

Schedule CT-IT Credit, Line 10, Column E (See instructions.):

Enter in Column D the lesser of your 2014 Form CT-8801, Part II,

Line 30, or Schedule CT-IT Credit, Line 9, Column A.

00

00

00

00

11. Total allowable credits: Add Column D on Lines 2, 4, 6, 8,

and 10. Enter the total here and on Form CT-1040, Line 13;

Form CT-1040NR/PY, Line 15; Form CT-1040X, Line 17;

or Form CT-1041, Line 8.

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3