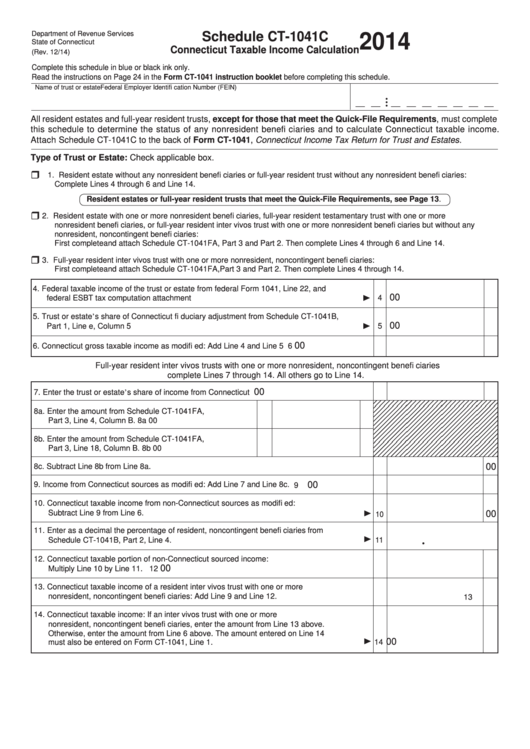

Schedule Ct-1041c - Connecticut Taxable Income Calculation - 2014

ADVERTISEMENT

Department of Revenue Services

Schedule CT-1041C

2014

State of Connecticut

Connecticut Taxable Income Calculation

(Rev. 12/14)

Complete this schedule in blue or black ink only.

Read the instructions on Page 24 in the Form CT-1041 instruction booklet before completing this schedule.

Name of trust or estate

Federal Employer Identifi cation Number (FEIN)

•

__ __

__ __ __ __ __ __ __

•

•

All resident estates and full-year resident trusts, except for those that meet the Quick-File Requirements, must complete

this schedule to determine the status of any nonresident benefi ciaries and to calculate Connecticut taxable income.

Attach Schedule CT-1041C to the back of Form CT-1041, Connecticut Income Tax Return for Trust and Estates.

Type of Trust or Estate: Check applicable box.

1. Resident estate without any nonresident benefi ciaries or full-year resident trust without any nonresident benefi ciaries:

Complete Lines 4 through 6 and Line 14.

Resident estates or full-year resident trusts that meet the Quick-File Requirements, see Page 13.

2. Resident estate with one or more nonresident benefi ciaries, full-year resident testamentary trust with one or more

nonresident benefi ciaries, or full-year resident inter vivos trust with one or more nonresident benefi ciaries but without any

nonresident, noncontingent benefi ciaries:

First complete and attach Schedule CT-1041FA, Part 3 and Part 2. Then complete Lines 4 through 6 and Line 14.

3. Full-year resident inter vivos trust with one or more nonresident, noncontingent benefi ciaries:

First complete and attach Schedule CT-1041FA, Part 3 and Part 2. Then complete Lines 4 through 14.

4. Federal taxable income of the trust or estate from federal Form 1041, Line 22, and

00

federal ESBT tax computation attachment

4

5. Trust or estate’s share of Connecticut fi duciary adjustment from Schedule CT-1041B,

00

Part 1, Line e, Column 5

5

00

6. Connecticut gross taxable income as modifi ed: Add Line 4 and Line 5

6

Full-year resident inter vivos trusts with one or more nonresident, noncontingent benefi ciaries

complete Lines 7 through 14. All others go to Line 14.

00

7. Enter the trust or estate’s share of income from Connecticut sources. See instructions.

7

8a. Enter the amount from Schedule CT-1041FA,

Part 3, Line 4, Column B.

8a

00

8b. Enter the amount from Schedule CT-1041FA,

Part 3, Line 18, Column B.

8b

00

00

8c. Subtract Line 8b from Line 8a.

8c

00

9. Income from Connecticut sources as modifi ed: Add Line 7 and Line 8c.

9

10. Connecticut taxable income from non-Connecticut sources as modifi ed:

Subtract Line 9 from Line 6.

00

10

11. Enter as a decimal the percentage of resident, noncontingent benefi ciaries from

Schedule CT-1041B, Part 2, Line 4.

11

•

12. Connecticut taxable portion of non-Connecticut sourced income:

00

Multiply Line 10 by Line 11.

12

13. Connecticut taxable income of a resident inter vivos trust with one or more

nonresident, noncontingent benefi ciaries: Add Line 9 and Line 12.

00

13

14. Connecticut taxable income: If an inter vivos trust with one or more

nonresident, noncontingent benefi ciaries, enter the amount from Line 13 above.

Otherwise, enter the amount from Line 6 above. The amount entered on Line 14

00

must also be entered on Form CT-1041, Line 1.

14

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1