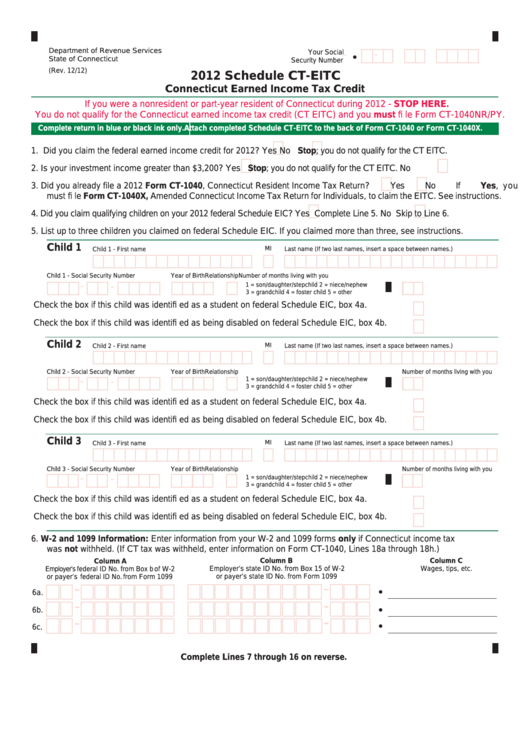

Department of Revenue Services

Your Social

-

-

State of Connecticut

Security Number

(Rev. 12/12)

2012 Schedule CT-EITC

Connecticut Earned Income Tax Credit

If you were a nonresident or part-year resident of Connecticut during 2012 - STOP HERE.

You do not qualify for the Connecticut earned income tax credit (CT EITC) and you must fi le Form CT-1040NR/PY.

Complete return in blue or black ink only.

Attach completed Schedule CT-EITC to the back of Form CT-1040 or Form CT-1040X.

1. Did you claim the federal earned income credit for 2012?

Yes

No Stop; you do not qualify for the CT EITC.

2. Is your investment income greater than $3,200?

Yes Stop; you do not qualify for the CT EITC.

No

3. Did you already file a 2012 Form CT-1040, Connecticut Resident Income Tax Return?

Yes

No If Yes, you

must fi le Form CT-1040X, Amended Connecticut Income Tax Return for Individuals, to claim the EITC. See instructions.

4. Did you claim qualifying children on your 2012 federal Schedule EIC?

Yes Complete Line 5.

No Skip to Line 6.

5. List up to three children you claimed on federal Schedule EIC. If you claimed more than three, see instructions.

Child 1

MI

Child 1 - First name

Last name (If two last names, insert a space between names.)

Child 1 - Social Security Number

Year of Birth

Relationship

Number of months living with you

-

1 = son/daughter/stepchild

2 = niece/nephew

-

3 = grandchild

4 = foster child

5 = other

Check the box if this child was identifi ed as a student on federal Schedule EIC, box 4a.

Check the box if this child was identifi ed as being disabled on federal Schedule EIC, box 4b.

Child 2

MI

Child 2 - First name

Last name (If two last names, insert a space between names.)

Child 2 - Social Security Number

Year of Birth

Relationship

Number of months living with you

1 = son/daughter/stepchild

2 = niece/nephew

-

-

3 = grandchild

4 = foster child

5 = other

Check the box if this child was identifi ed as a student on federal Schedule EIC, box 4a.

Check the box if this child was identifi ed as being disabled on federal Schedule EIC, box 4b.

Child 3

MI

Child 3 - First name

Last name (If two last names, insert a space between names.)

Child 3 - Social Security Number

Year of Birth

Relationship

Number of months living with you

-

1 = son/daughter/stepchild

2 = niece/nephew

-

3 = grandchild

4 = foster child

5 = other

Check the box if this child was identifi ed as a student on federal Schedule EIC, box 4a.

Check the box if this child was identifi ed as being disabled on federal Schedule EIC, box 4b.

6. W-2 and 1099 Information: Enter information from your W-2 and 1099 forms only if Connecticut income tax

was not withheld. (If CT tax was withheld, enter information on Form CT-1040, Lines 18a through 18h.)

Column A

Column B

Column C

Employer’s state ID No. from Box 15 of W-2

Wages, tips, etc.

Employer’s federal ID No. from Box b of W-2

or payer’s state ID No. from Form 1099

or payer’s federal ID No. from Form 1099

–

–

6a.

–

–

6b.

–

–

6c.

Complete Lines 7 through 16 on reverse.

1

1 2

2