Form Ct-1120a-Bpe - Corporation Business Tax Return - Apportionment Computation - Broadcasters And Production Entities

ADVERTISEMENT

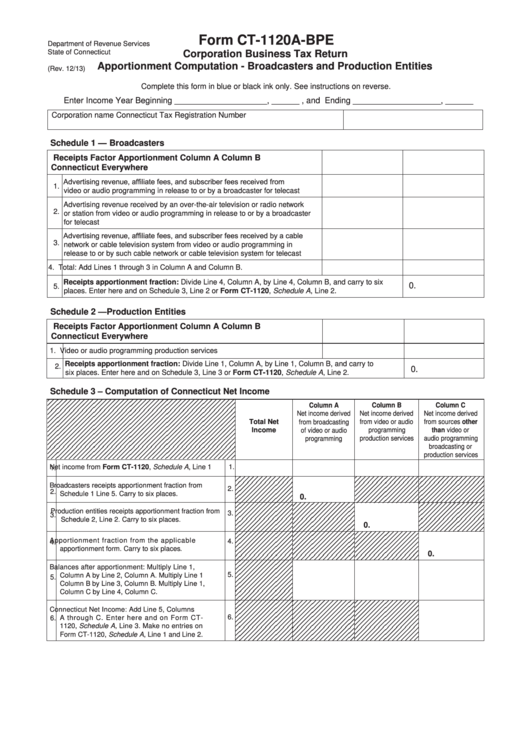

Form CT-1120A-BPE

Department of Revenue Services

State of Connecticut

Corporation Business Tax Return

Apportionment Computation - Broadcasters and Production Entities

(Rev. 12/13)

Complete this form in blue or black ink only. See instructions on reverse.

Enter Income Year Beginning ____________________, ______ , and Ending ___________________, ______

Corporation name

Connecticut Tax Registration Number

Schedule 1 — Broadcasters

Receipts Factor Apportionment

Column A

Column B

Connecticut

Everywhere

Advertising revenue, affiliate fees, and subscriber fees received from

1.

video or audio programming in release to or by a broadcaster for telecast

Advertising revenue received by an over-the-air television or radio network

2.

or station from video or audio programming in release to or by a broadcaster

for telecast

Advertising revenue, affiliate fees, and subscriber fees received by a cable

3.

network or cable television system from video or audio programming in

release to or by such cable network or cable television system for telecast

4. Total: Add Lines 1 through 3 in Column A and Column B.

Receipts apportionment fraction: Divide Line 4, Column A, by Line 4, Column B, and carry to six

0.

5.

places. Enter here and on Schedule 3, Line 2 or Form CT-1120, Schedule A, Line 2.

Schedule 2 — Production Entities

Receipts Factor Apportionment

Column A

Column B

Connecticut

Everywhere

1. Video or audio programming production services

2. Receipts apportionment fraction: Divide Line 1, Column A, by Line 1, Column B, and carry to

0.

six places. Enter here and on Schedule 3, Line 3 or Form CT-1120, Schedule A, Line 2.

Schedule 3 – Computation of Connecticut Net Income

Column A

Column B

Column C

Net income derived

Net income derived

Net income derived

Total Net

from broadcasting

from video or audio

from sources other

Income

programming

than video or

of video or audio

production services

audio programming

programming

broadcasting or

production services

Net income from Form CT-1120, Schedule A, Line 1

1.

1.

Broadcasters receipts apportionment fraction from

2.

2.

Schedule 1 Line 5. Carry to six places.

0.

Production entities receipts apportionment fraction from

3.

3.

Schedule 2, Line 2. Carry to six places.

0.

Apportionment fraction from the applicable

4.

4.

apportionment form. Carry to six places .

0.

Balances after apportionment: Multiply Line 1,

5.

Column A by Line 2, Column A. Multiply Line 1

5.

Column B by Line 3, Column B. Multiply Line 1,

Column C by Line 4, Column C.

Connecticut Net Income: Add Line 5, Columns

6.

6.

A through C. Enter here and on Form CT-

1120, Schedule A, Line 3. Make no entries on

Form CT-1120, Schedule A, Line 1 and Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2