Form Ct-1120a-Bmc - Corporation Business Tax Return Apportionment Computation - Motor Bus And Motor Carrier Companies

ADVERTISEMENT

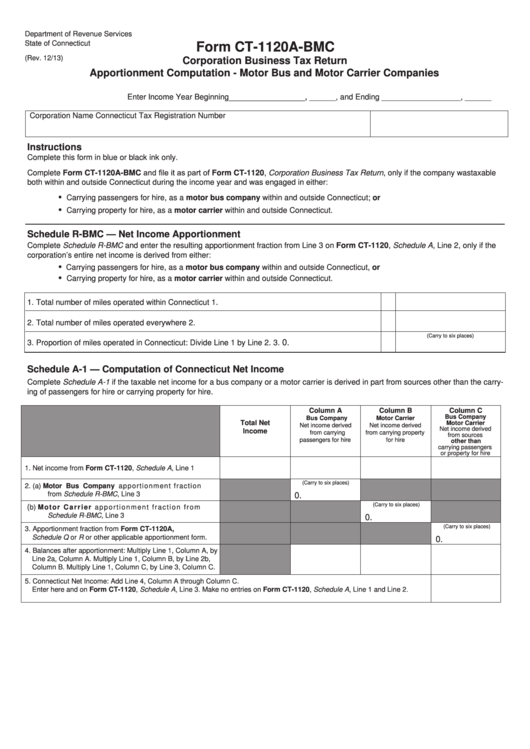

Department of Revenue Services

State of Connecticut

Form CT-1120A-BMC

(Rev. 12/13)

Corporation Business Tax Return

Apportionment Computation - Motor Bus and Motor Carrier Companies

________________,

EEEEgfregfrrga

EEEEEnter Income Year Beginning

______, and Ending __________________, ______

Corporation Name

Connecticut Tax Registration Number

Instructions

Complete this form in blue or black ink only.

Complete Form CT-1120A-BMC and file it as part of Form CT-1120, Corporation Business Tax Return, only if the company was taxable

both within and outside Connecticut during the income year and was engaged in either:

•

Carrying passengers for hire, as a motor bus company within and outside Connecticut; or

•

Carrying property for hire, as a motor carrier within and outside Connecticut.

Schedule R-BMC — Net Income Apportionment

Complete Schedule R-BMC and enter the resulting apportionment fraction from Line 3 on Form CT-1120, Schedule A, Line 2, only if the

corporation’s entire net income is derived from either:

•

Carrying passengers for hire, as a motor bus company within and outside Connecticut, or

•

Carrying property for hire, as a motor carrier within and outside Connecticut.

1. Total number of miles operated within Connecticut

1.

2. Total number of miles operated everywhere

2.

(Carry to six places)

0.

3. Proportion of miles operated in Connecticut: Divide Line 1 by Line 2.

3.

Schedule A-1 — Computation of Connecticut Net Income

Complete Schedule A-1 if the taxable net income for a bus company or a motor carrier is derived in part from sources other than the carry-

ing of passengers for hire or carrying property for hire.

Column A

Column B

Column C

Bus Company

Bus Company

Motor Carrier

Total Net

Motor Carrier

Net income derived

Net income derived

Net income derived

Income

from carrying

from carrying property

from sources

passengers for hire

for hire

other than

carrying passengers

or property for hire

1. Net income from Form CT-1120, Schedule A, Line 1

(Carry to six places)

2. (a) Motor Bus Company apportionment fraction

from Schedule R-BMC, Line 3

0.

(Carry to six places)

(

b) M o t o r C a r r i e r a p p o r t i o n m e n t f r a c t i o n f r o m

Schedule R-BMC, Line 3

0.

(Carry to six places)

3. A p p o r t i o n m e n t f r a c t i o n f r o m F o r m C T- 11 2 0 A ,

Schedule Q or R or other applicable apportionment form.

0.

4. Balances after apportionment: Multiply Line 1, Column A, by

Line 2a, Column A. Multiply Line 1, Column B, by Line 2b,

Column B. Multiply Line 1, Column C, by Line 3, Column C.

5. Connecticut Net Income: Add Line 4, Column A through Column C.

Enter here and on Form CT-1120, Schedule A, Line 3. Make no entries on Form CT-1120, Schedule A, Line 1 and Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1