Form Ct-1120a-A - Corporation Business Tax Return - Apportionment Computation - Air Carriers

ADVERTISEMENT

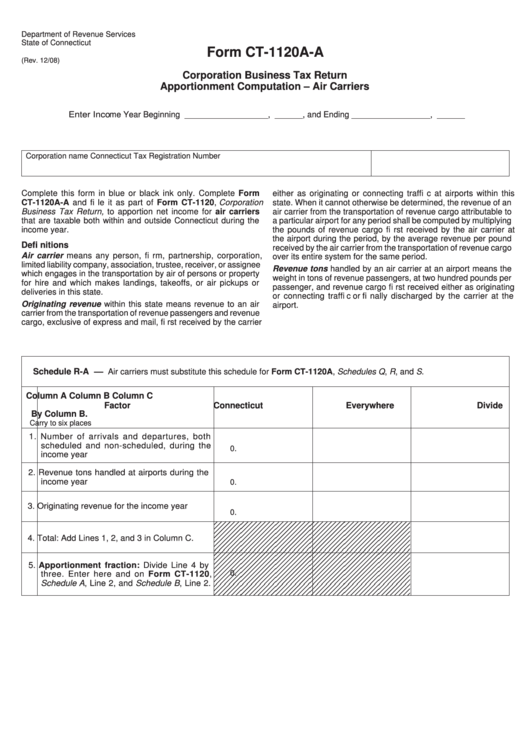

Department of Revenue Services

State of Connecticut

Form CT-1120A-A

(Rev. 12/08)

Corporation Business Tax Return

Apportionment Computation – Air Carriers

Enter Income Year Beginning __________________, ______, and Ending _________________, ______

Corporation name

Connecticut Tax Registration Number

Complete this form in blue or black ink only. Complete Form

either as originating or connecting traffi c at airports within this

CT-1120A-A and fi le it as part of Form CT-1120, Corporation

state. When it cannot otherwise be determined, the revenue of an

Business Tax Return, to apportion net income for air carriers

air carrier from the transportation of revenue cargo attributable to

that are taxable both within and outside Connecticut during the

a particular airport for any period shall be computed by multiplying

income year.

the pounds of revenue cargo fi rst received by the air carrier at

the airport during the period, by the average revenue per pound

Defi nitions

received by the air carrier from the transportation of revenue cargo

Air carrier means any person, fi rm, partnership, corporation,

over its entire system for the same period.

limited liability company, association, trustee, receiver, or assignee

Revenue tons handled by an air carrier at an airport means the

which engages in the transportation by air of persons or property

weight in tons of revenue passengers, at two hundred pounds per

for hire and which makes landings, takeoffs, or air pickups or

passenger, and revenue cargo fi rst received either as originating

deliveries in this state.

or connecting traffi c or fi nally discharged by the carrier at the

Originating revenue within this state means revenue to an air

airport.

carrier from the transportation of revenue passengers and revenue

cargo, exclusive of express and mail, fi rst received by the carrier

Schedule R-A

–– Air carriers must substitute this schedule for Form CT-1120A, Schedules Q, R, and S.

Column A

Column B

Column C

Factor

Connecticut

Everywhere

Divide Column A

By Column B.

Carry to six places

1. Number of arrivals and departures, both

scheduled and non-scheduled, during the

0.

income year

2. Revenue tons handled at airports during the

income year

0.

3. Originating revenue for the income year

0.

4. Total: Add Lines 1, 2, and 3 in Column C.

5. Apportionment fraction: Divide Line 4 by

0.

three. Enter here and on Form CT-1120,

Schedule A, Line 2, and Schedule B, Line 2.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1