P r o p e r t y T a x

R e n d i t i o n o f P r o p e r t y Q u a l i f i e d f o r A l l o c a t i o n o f V a l u e

Form 50-145

STEP 1: Property Owner’s Name and Address

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

_____________________________________________________________________

___________________________

City, State, ZIP Code

Phone (area code and number)

Property Owner is a(n) (check one):

Individual

Association

Corporation

Nonprofit Corporation

STEP 2: If your property is commercial aircraft or fleet of commercial aircraft other than business aircraft (see step 5):

Complete Schedule A-1: commercial aircraft information. Check if attached:

STEP 3: If your property is a vessel or fleet of vessels or other watercraft:

Complete Schedule A-2: vessel information. Check if attached:

STEP 4: If your property is a motor vehicle or fleet of motor vehicles:

Complete Schedule A-3: motor vehicle information. Check if attached:

STEP 5: If your property is a business aircraft or fleet of business aircraft:

Complete Schedule A-4: business aircraft information. Check if attached:

STEP 6: If your property is equipment in interstate commerce not listed above:

Complete Schedule A-5: equipment information. Check if attached:

Please indicate if you are filling out this form as:

Authorized Agent

Fiduciary

Secured Party

___________________________________________________________________________________________________

Name of Authorized Agent, Fiduciary, or Secured Party

___________________________________________________________________________________________________

Present Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

By checking this box, I affirm that the information contained in my most recent rendition statement filed for a prior tax year (this rendition was filed for

______________

the

tax year) continues to be complete and accurate for the current tax year.

Are you the property owner, an employee of the property owner, or an employee of a property owner on behalf of an affiliated

entity of the property owner? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Are you a secured party with a security interest in the property subject to this rendition and with a historical cost new of more than

$50,000, as defined and required by Tax Code Section 22.01(c-1) and (c-2)? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

If you checked “Yes” to this question, you must attach a document signed by the property owner indicating consent for you to file the rendition.

For more information, visit our website:

Page 2 • 50-145 • 07-13/9

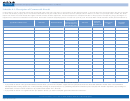

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8