P r o p e r t y T a x

Rendition of Property Qualified for Allocation of Value – Schedules

Form 50-145

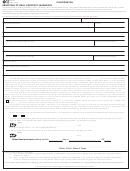

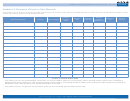

Schedule A-4: Description of Business Aircraft

A “situs state” is one in which the aircraft was continually used in the past 12 months, or was present on the state’s lien date, or in which the owner was domiciled in the past 12 months

or which has levied a property tax on the business aircraft for this year. Texas situs is the owner’s principal office in Texas or, if there is no principal office in Texas, the Texas airport

from which the business aircraft makes the highest number of Texas departures. A departure is a departure made for the purpose of transporting cargo, passengers or equipment for

which the aircraft is employed as it moves from point to point. This includes aircraft belonging to a person not in the business of providing air transportation.

Total Number

Total Number

of Departures

of Departures

Good Faith

Original Cost**

Year Placed

Type, Make and Model of Item

I.D. Number

Other Situs State(s)

from Texas

from All

Texas Situs

Estimate of

(and)

in Service

Locations in the

Locations in the

Market Value* (or)

Preceeding Year

Preceeding Year

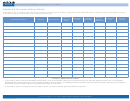

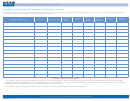

Continue on additional sheets if needed

* If you provide an amount in the “good faith estimate of market value,” you need not complete a “original cost” and “year placed in service.” “Good faith estimate of market value” is not admissible in

subsequent protest, hearing, appeal, suit, or other proceeding involving the property except for: (1) proceedings to determine whether a person complied with rendition requirement; (2) proceedings for

determination of fraud or intent to evade tax; or (3) a protest under Section 41.41, Tax Code.

** If you provide an amount in a “original cost” and “year placed in service,” you need not complete “good faith estimate of market value.”

For more information, visit our website:

50-145 • 07-13/9 • Page 7

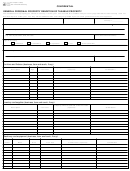

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8