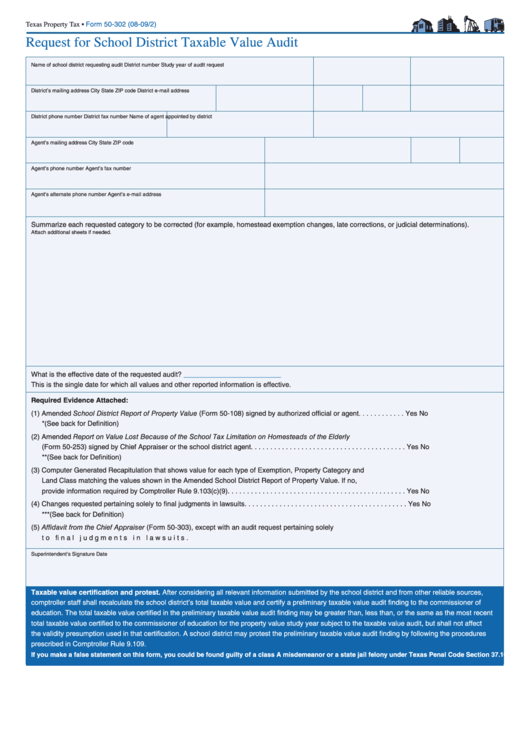

Texas Property Tax •

Form 50-302 (08-09/2)

Request for School District Taxable Value Audit

Name of school district requesting audit

District number

Study year of audit request

District’s mailing address

City

State

ZIP code

District e-mail address

District phone number

District fax number

Name of agent appointed by district

Agent’s mailing address

City

State

ZIP code

Agent’s phone number

Agent’s fax number

Agent’s alternate phone number

Agent’s e-mail address

Summarize each requested category to be corrected (for example, homestead exemption changes, late corrections, or judicial determinations).

Attach additional sheets if needed.

What is the effective date of the requested audit?

_________________________

This is the single date for which all values and other reported information is effective.

Required Evidence Attached:

(1) Amended School District Report of Property Value (Form 50-108) signed by authorized official or agent. . . . . . . . . . . .

Yes

No

*(See back for Definition)

(2) Amended Report on Value Lost Because of the School Tax Limitation on Homesteads of the Elderly

(Form 50-253) signed by Chief Appraiser or the school district agent. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

**(See back for Definition)

(3) Computer Generated Recapitulation that shows value for each type of Exemption, Property Category and

Land Class matching the values shown in the Amended School District Report of Property Value. If no,

provide information required by Comptroller Rule 9.103(c)(9). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

(4) Changes requested pertaining solely to final judgments in lawsuits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

***(See back for Definition)

(5) Affidavit from the Chief Appraiser (Form 50-303), except with an audit request pertaining solely

to final judgments in lawsuits. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Yes

No

Superintendent’s Signature

Date

Taxable value certification and protest. After considering all relevant information submitted by the school district and from other reliable sources,

comptroller staff shall recalculate the school district’s total taxable value and certify a preliminary taxable value audit finding to the commissioner of

education. The total taxable value certified in the preliminary taxable value audit finding may be greater than, less than, or the same as the most recent

total taxable value certified to the commissioner of education for the property value study year subject to the taxable value audit, but shall not affect

the validity presumption used in that certification. A school district may protest the preliminary taxable value audit finding by following the procedures

prescribed in Comptroller Rule 9.109.

If you make a false statement on this form, you could be found guilty of a class A misdemeanor or a state jail felony under Texas Penal Code Section 37 .10.

1

1 2

2