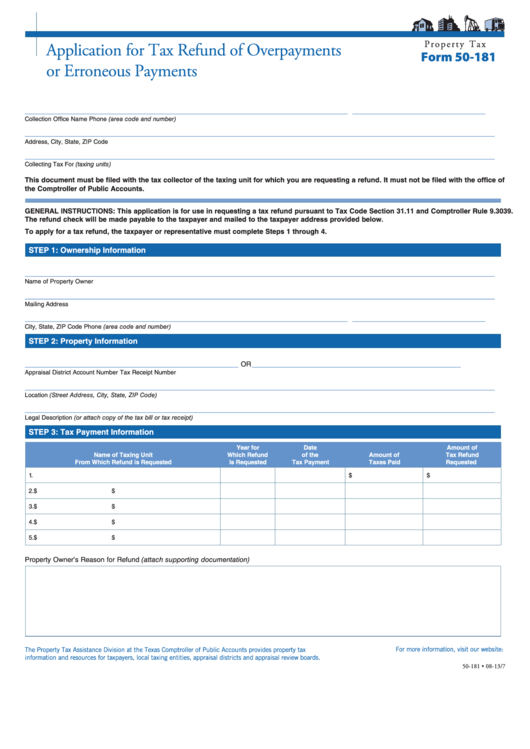

P r o p e r t y T a x

Application for Tax Refund of Overpayments

Form 50-181

or Erroneous Payments

____________________________________________________________________

____________________________

Collection Office Name

Phone (area code and number)

___________________________________________________________________________________________________

Address, City, State, ZIP Code

___________________________________________________________________________________________________

Collecting Tax For (taxing units)

This document must be filed with the tax collector of the taxing unit for which you are requesting a refund. It must not be filed with the office of

the Comptroller of Public Accounts.

GENERAL INSTRUCTIONS: This application is for use in requesting a tax refund pursuant to Tax Code Section 31.11 and Comptroller Rule 9.3039.

The refund check will be made payable to the taxpayer and mailed to the taxpayer address provided below.

To apply for a tax refund, the taxpayer or representative must complete Steps 1 through 4.

STEP 1: Ownership Information

___________________________________________________________________________________________________

Name of Property Owner

___________________________________________________________________________________________________

Mailing Address

____________________________________________________________________

____________________________

City, State, ZIP Code

Phone (area code and number)

STEP 2: Property Information

_____________________________________________

____________________________________________

OR

Appraisal District Account Number

Tax Receipt Number

___________________________________________________________________________________________________

Location (Street Address, City, State, ZIP Code)

___________________________________________________________________________________________________

Legal Description (or attach copy of the tax bill or tax receipt)

STEP 3: Tax Payment Information

Year for

Date

Amount of

Name of Taxing Unit

Which Refund

of the

Amount of

Tax Refund

From Which Refund is Requested

Is Requested

Tax Payment

Taxes Paid

Requested

1.

$

$

2.

$

$

3.

$

$

4.

$

$

5.

$

$

Property Owner’s Reason for Refund (attach supporting documentation)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-181 • 08-13/7

1

1 2

2