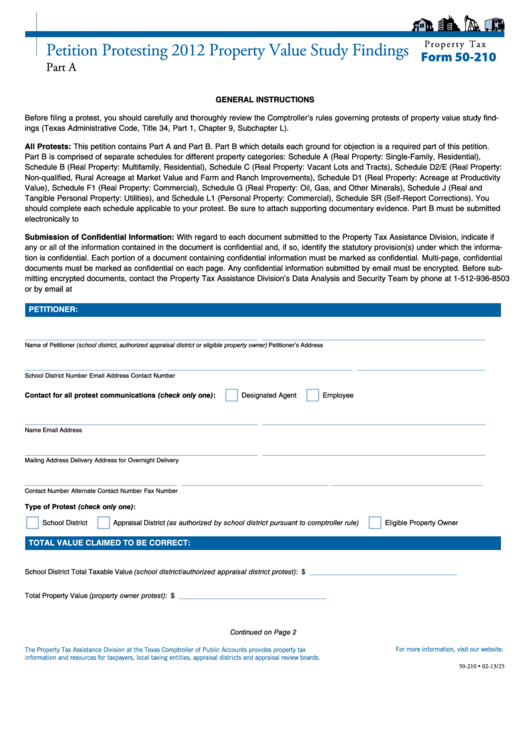

P r o p e r t y T a x

Petition Protesting 2012 Property Value Study Findings

Form 50-210

Part A

GENERAL INSTRUCTIONS

Before filing a protest, you should carefully and thoroughly review the Comptroller’s rules governing protests of property value study find-

ings (Texas Administrative Code, Title 34, Part 1, Chapter 9, Subchapter L).

All Protests: This petition contains Part A and Part B. Part B which details each ground for objection is a required part of this petition.

Part B is comprised of separate schedules for different property categories: Schedule A (Real Property: Single-Family, Residential),

Schedule B (Real Property: Multifamily, Residential), Schedule C (Real Property: Vacant Lots and Tracts), Schedule D2/E (Real Property:

Non-qualified, Rural Acreage at Market Value and Farm and Ranch Improvements), Schedule D1 (Real Property: Acreage at Productivity

Value), Schedule F1 (Real Property: Commercial), Schedule G (Real Property: Oil, Gas, and Other Minerals), Schedule J (Real and

Tangible Personal Property: Utilities), and Schedule L1 (Personal Property: Commercial), Schedule SR (Self-Report Corrections). You

should complete each schedule applicable to your protest. Be sure to attach supporting documentary evidence. Part B must be submitted

electronically to ptad.appeals@cpa.state.tx.us.

Submission of Confidential Information: With regard to each document submitted to the Property Tax Assistance Division, indicate if

any or all of the information contained in the document is confidential and, if so, identify the statutory provision(s) under which the informa-

tion is confidential. Each portion of a document containing confidential information must be marked as confidential. Multi-page, confidential

documents must be marked as confidential on each page. Any confidential information submitted by email must be encrypted. Before sub-

mitting encrypted documents, contact the Property Tax Assistance Division’s Data Analysis and Security Team by phone at 1-512-936-8503

or by email at ptad.appeals@cpa.state.tx.us.

PETITIONER:

_________________________________________________

_______________________________________________

Name of Petitioner (school district, authorized appraisal district or eligible property owner)

Petitioner’s Address

_____________________________

_______________________________________

___________________________

School District Number

Email Address

Contact Number

Contact for all protest communications (check only one):

Designated Agent

Employee

_________________________________________________

_______________________________________________

Name

Email Address

_________________________________________________

_______________________________________________

Mailing Address

Delivery Address for Overnight Delivery

________________________________

_______________________________

________________________________

Contact Number

Alternate Contact Number

Fax Number

Type of Protest (check only one):

School District

Appraisal District (as authorized by school district pursuant to comptroller rule)

Eligible Property Owner

TOTAL VALUE CLAIMED TO BE CORRECT:

_______________________________

School District Total Taxable Value (school district/authorized appraisal district protest): . . . . . . . . .

$

_______________________________

Total Property Value (property owner protest): . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Continued on Page 2

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-210 • 02-13/25

1

1 2

2