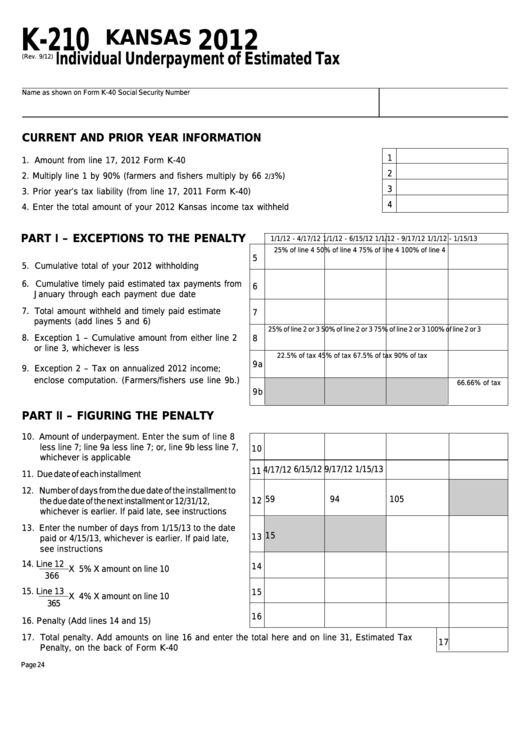

K-210

KANSAS

2012

Individual Underpayment of Estimated Tax

(Rev. 9/12)

Name as shown on Form K-40

Social Security Number

CURRENT AND PRIOR YEAR INFORMATION

1

1. Amount from line 17, 2012 Form K-40 ...............................................................................

2

2. Multiply line 1 by 90% (farmers and fishers multiply by 66

%) .....................................

2/3

3

3. Prior year’s tax liability (from line 17, 2011 Form K-40) ...................................................

4

4. Enter the total amount of your 2012 Kansas income tax withheld ...................................

PART I – EXCEPTIONS TO THE PENALTY

1/1/12 - 4/17/12

1/1/12 - 6/15/12

1/1/12 - 9/17/12

1/1/12 - 1/15/13

25% of line 4

50% of line 4

75% of line 4

100% of line 4

5

5. Cumulative total of your 2012 withholding ................

6. Cumulative timely paid estimated tax payments from

6

January through each payment due date .................

7. Total amount withheld and timely paid estimate

7

payments (add lines 5 and 6) ....................................

25% of line 2 or 3

50% of line 2 or 3

75% of line 2 or 3

100% of line 2 or 3

8. Exception 1 – Cumulative amount from either line 2

8

or line 3, whichever is less .........................................

22.5% of tax

45% of tax

67.5% of tax

90% of tax

9a

9. Exception 2 – Tax on annualized 2012 income;

enclose computation. (Farmers/fishers use line 9b.)

66.66% of tax

9b

PART II – FIGURING THE PENALTY

10. Amount of underpayment. Enter the sum of line 8

less line 7; line 9a less line 7; or, line 9b less line 7,

10

whichever is applicable ............................................

6/15/12

9/17/12

1/15/13

4/17/12

11

11. Due date of each installment .......................................

12. Number of days from the due date of the installment to

59

94

105

12

the due date of the next installment or 12/31/12,

whichever is earlier. If paid late, see instructions .....

13. Enter the number of days from 1/15/13 to the date

15

13

paid or 4/15/13, whichever is earlier. If paid late,

see instructions ........................................................

14. Line 12

14

X 5% X amount on line 10 .......................

366

15. Line 13

15

X 4% X amount on line 10 ..........................

365

16

16. Penalty (Add lines 14 and 15) ...................................

17. Total penalty. Add amounts on line 16 and enter the total here and on line 31, Estimated Tax

17

Penalty, on the back of Form K-40 ......................................................................................................

Page 24

1

1 2

2