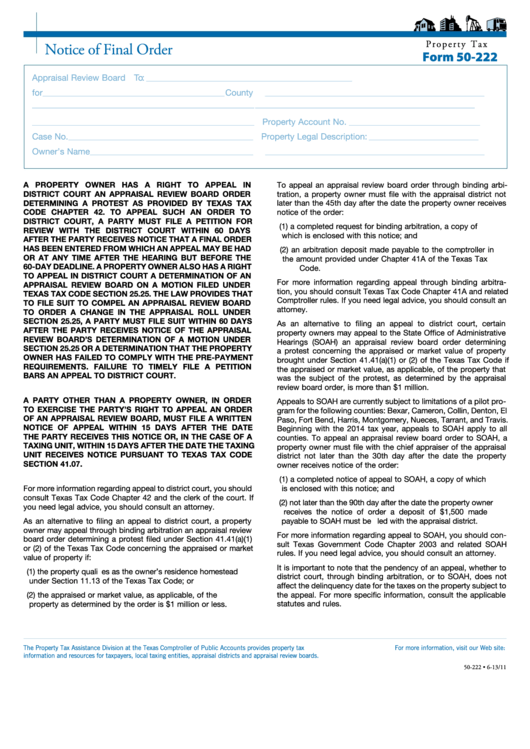

P r o p e r t y T a x

Notice of Final Order

Form 50-222

Appraisal Review Board

To:

_____________________________________________________________________________

for

County

____________________________________________________________________

__________________________________________________________________________________

___________________________________________________________________________________

__________________________________________________________________________________

Property Account No.

___________________________________________________________________________________

_________________________________________________

Case No.

Property Legal Description:

_____________________________________________________________________

_________________________________________

Owner’s Name

_____________________________________________________________

__________________________________________________________________________________

A PROPERTY OWNER HAS A RIGHT TO APPEAL IN

To appeal an appraisal review board order through binding arbi-

DISTRICT COURT AN APPRAISAL REVIEW BOARD ORDER

tration, a property owner must file with the appraisal district not

DETERMINING A PROTEST AS PROVIDED BY TEXAS TAX

later than the 45th day after the date the property owner receives

CODE CHAPTER 42. TO APPEAL SUCH AN ORDER TO

notice of the order:

DISTRICT COURT, A PARTY MUST FILE A PETITION FOR

(1) a completed request for binding arbitration, a copy of

REVIEW WITH THE DISTRICT COURT WITHIN 60 DAYS

which is enclosed with this notice; and

AFTER THE PARTY RECEIVES NOTICE THAT A FINAL ORDER

HAS BEEN ENTERED FROM WHICH AN APPEAL MAY BE HAD

(2) an arbitration deposit made payable to the comptroller in

OR AT ANY TIME AFTER THE HEARING BUT BEFORE THE

the amount provided under Chapter 41A of the Texas Tax

60-DAY DEADLINE. A PROPERTY OWNER ALSO HAS A RIGHT

Code.

TO APPEAL IN DISTRICT COURT A DETERMINATION OF AN

For more information regarding appeal through binding arbitra-

APPRAISAL REVIEW BOARD ON A MOTION FILED UNDER

tion, you should consult Texas Tax Code Chapter 41A and related

TEXAS TAX CODE SECTION 25.25. THE LAW PROVIDES THAT

Comptroller rules. If you need legal advice, you should consult an

TO FILE SUIT TO COMPEL AN APPRAISAL REVIEW BOARD

attorney.

TO ORDER A CHANGE IN THE APPRAISAL ROLL UNDER

SECTION 25.25, A PARTY MUST FILE SUIT WITHIN 60 DAYS

As an alternative to filing an appeal to district court, certain

AFTER THE PARTY RECEIVES NOTICE OF THE APPRAISAL

property owners may appeal to the State Office of Administrative

REVIEW BOARD’S DETERMINATION OF A MOTION UNDER

Hearings (SOAH) an appraisal review board order determining

SECTION 25.25 OR A DETERMINATION THAT THE PROPERTY

a protest concerning the appraised or market value of property

OWNER HAS FAILED TO COMPLY WITH THE PRE-PAYMENT

brought under Section 41.41(a)(1) or (2) of the Texas Tax Code if

REQUIREMENTS. FAILURE TO TIMELY FILE A PETITION

the appraised or market value, as applicable, of the property that

BARS AN APPEAL TO DISTRICT COURT.

was the subject of the protest, as determined by the appraisal

review board order, is more than $1 million.

A PARTY OTHER THAN A PROPERTY OWNER, IN ORDER

Appeals to SOAH are currently subject to limitations of a pilot pro-

TO EXERCISE THE PARTY’S RIGHT TO APPEAL AN ORDER

gram for the following counties: Bexar, Cameron, Collin, Denton, El

OF AN APPRAISAL REVIEW BOARD, MUST FILE A WRITTEN

Paso, Fort Bend, Harris, Montgomery, Nueces, Tarrant, and Travis.

NOTICE OF APPEAL WITHIN 15 DAYS AFTER THE DATE

Beginning with the 2014 tax year, appeals to SOAH apply to all

THE PARTY RECEIVES THIS NOTICE OR, IN THE CASE OF A

counties. To appeal an appraisal review board order to SOAH, a

TAXING UNIT, WITHIN 15 DAYS AFTER THE DATE THE TAXING

property owner must file with the chief appraiser of the appraisal

UNIT RECEIVES NOTICE PURSUANT TO TEXAS TAX CODE

district not later than the 30th day after the date the property

SECTION 41.07.

owner receives notice of the order:

(1) a completed notice of appeal to SOAH, a copy of which

is enclosed with this notice; and

For more information regarding appeal to district court, you should

consult Texas Tax Code Chapter 42 and the clerk of the court. If

(2) not later than the 90th day after the date the property owner

you need legal advice, you should consult an attorney.

receives the notice of order a deposit of $1,500 made

As an alternative to filing an appeal to district court, a property

payable to SOAH must be filed with the appraisal district.

owner may appeal through binding arbitration an appraisal review

For more information regarding appeal to SOAH, you should con-

board order determining a protest filed under Section 41.41(a)(1)

sult Texas Government Code Chapter 2003 and related SOAH

or (2) of the Texas Tax Code concerning the appraised or market

rules. If you need legal advice, you should consult an attorney.

value of property if:

It is important to note that the pendency of an appeal, whether to

(1) the property qualifies as the owner’s residence homestead

district court, through binding arbitration, or to SOAH, does not

under Section 11.13 of the Texas Tax Code; or

affect the delinquency date for the taxes on the property subject to

the appeal. For more specific information, consult the applicable

(2) the appraised or market value, as applicable, of the

statutes and rules.

property as determined by the order is $1 million or less.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our Web site:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-222 • 6-13/11

1

1