Notice of

50-211

Effective

(Rev. 05-06/8)

Tax Rate

Property Tax Rates in

(for use by counties)

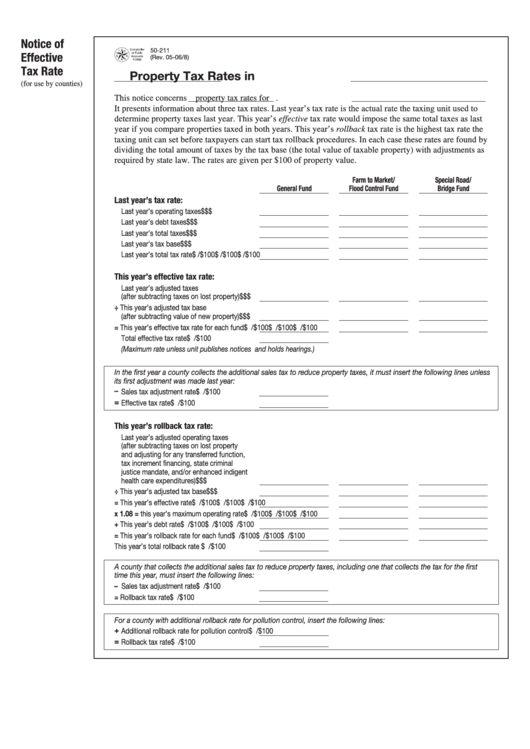

This notice concerns

property tax rates for

.

It presents information about three tax rates. Last year’s tax rate is the actual rate the taxing unit used to

determine property taxes last year. This year’s effective tax rate would impose the same total taxes as last

year if you compare properties taxed in both years. This year’s rollback tax rate is the highest tax rate the

taxing unit can set before taxpayers can start tax rollback procedures. In each case these rates are found by

dividing the total amount of taxes by the tax base (the total value of taxable property) with adjustments as

required by state law. The rates are given per $100 of property value.

Farm to Market/

Special Road/

General Fund

Flood Control Fund

Bridge Fund

Last year’s tax rate:

Last year’s operating taxes

$

$

$

Last year’s debt taxes

$

$

$

Last year’s total taxes

$

$

$

Last year’s tax base

$

$

$

Last year’s total tax rate

$

/$100

$

/$100

$

/$100

This year’s effective tax rate:

Last year’s adjusted taxes

(after subtracting taxes on lost property)

$

$

$

÷ This year’s adjusted tax base

(after subtracting value of new property)

$

$

$

= This year’s effective tax rate for each fund

$

/$100

$

/$100

$

/$100

Total effective tax rate

$

/$100

(Maximum rate unless unit publishes notices and holds hearings.)

In the first year a county collects the additional sales tax to reduce property taxes, it must insert the following lines unless

its first adjustment was made last year:

– Sales tax adjustment rate

$

/$100

= Effective tax rate

$

/$100

This year’s rollback tax rate:

Last year’s adjusted operating taxes

(after subtracting taxes on lost property

and adjusting for any transferred function,

tax increment financing, state criminal

justice mandate, and/or enhanced indigent

health care expenditures)

$

$

$

÷ This year’s adjusted tax base

$

$

$

= This year’s effective rate

$

/$100

$

/$100

$

/$100

x 1.08 = this year’s maximum operating rate

$

/$100

$

/$100

$

/$100

+ This year’s debt rate

$

/$100

$

/$100

$

/$100

= This year’s rollback rate for each fund

$

/$100

$

/$100

$

/$100

This year’s total rollback rate

$

/$100

A county that collects the additional sales tax to reduce property taxes, including one that collects the tax for the first

time this year, must insert the following lines:

– Sales tax adjustment rate

$

/$100

= Rollback tax rate

$

/$100

For a county with additional rollback rate for pollution control, insert the following lines:

+ Additional rollback rate for pollution control

$

/$100

= Rollback tax rate

$

/$100

1

1