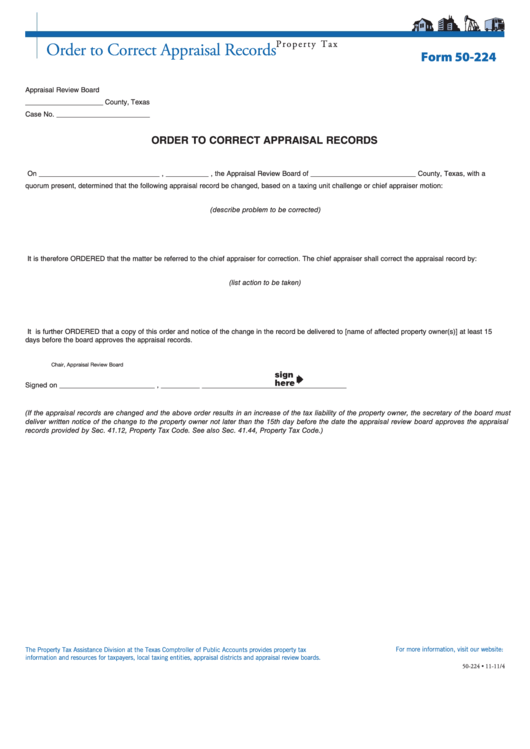

P r o p e r t y T a x

Order to Correct Appraisal Records

Form 50-224

Appraisal Review Board

____________________ County, Texas

Case No. ________________________

ORDER TO CORRECT APPRAISAL RECORDS

On _______________________________ , ___________ , the Appraisal Review Board of ___________________________ County, Texas, with a

quorum present, determined that the following appraisal record be changed, based on a taxing unit challenge or chief appraiser motion:

(describe problem to be corrected)

It is therefore ORDERED that the matter be referred to the chief appraiser for correction. The chief appraiser shall correct the appraisal record by:

(list action to be taken)

It is further ORDERED that a copy of this order and notice of the change in the record be delivered to [name of affected property owner(s)] at least 15

days before the board approves the appraisal records.

Chair, Appraisal Review Board

Signed on ___________________________ , ___________

_________________________________________

(If the appraisal records are changed and the above order results in an increase of the tax liability of the property owner, the secretary of the board must

deliver written notice of the change to the property owner not later than the 15th day before the date the appraisal review board approves the appraisal

records provided by Sec. 41.12, Property Tax Code. See also Sec. 41.44, Property Tax Code.)

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-224 • 11-11/4

1

1