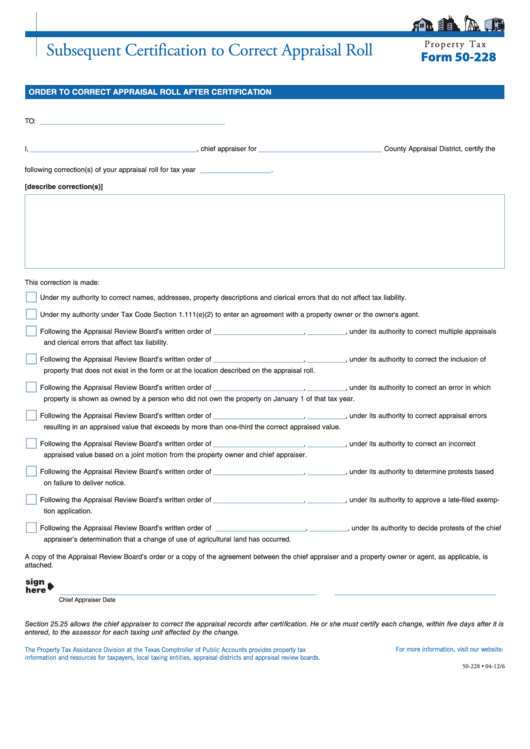

P r o p e r t y T a x

Subsequent Certification to Correct Appraisal Roll

Form 50-228

ORDER TO CORRECT APPRAISAL ROLL AFTER CERTIFICATION

_______________________________________

TO:

___________________________________

__________________________

I,

, chief appraiser for

County Appraisal District, certify the

_______________

following correction(s) of your appraisal roll for tax year

.

[describe correction(s)]

This correction is made:

Under my authority to correct names, addresses, property descriptions and clerical errors that do not affect tax liability.

Under my authority under Tax Code Section 1.111(e)(2) to enter an agreement with a property owner or the owner's agent.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to correct multiple appraisals

and clerical errors that affect tax liability.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to correct the inclusion of

property that does not exist in the form or at the location described on the appraisal roll.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to correct an error in which

property is shown as owned by a person who did not own the property on January 1 of that tax year.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to correct appraisal errors

resulting in an appraised value that exceeds by more than one-third the correct appraised value.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to correct an incorrect

appraised value based on a joint motion from the property owner and chief appraiser.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to determine protests based

on failure to deliver notice.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to approve a late-filed exemp-

tion application.

___________________

________

Following the Appraisal Review Board’s written order of

,

, under its authority to decide protests of the chief

appraiser’s determination that a change of use of agricultural land has occurred.

A copy of the Appraisal Review Board’s order or a copy of the agreement between the chief appraiser and a property owner or agent, as applicable, is

attached.

______________________________________________________

__________________________________

Chief Appraiser

Date

Section 25.25 allows the chief appraiser to correct the appraisal records after certification. He or she must certify each change, within five days after it is

entered, to the assessor for each taxing unit affected by the change.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-228 • 04-12/6

1

1