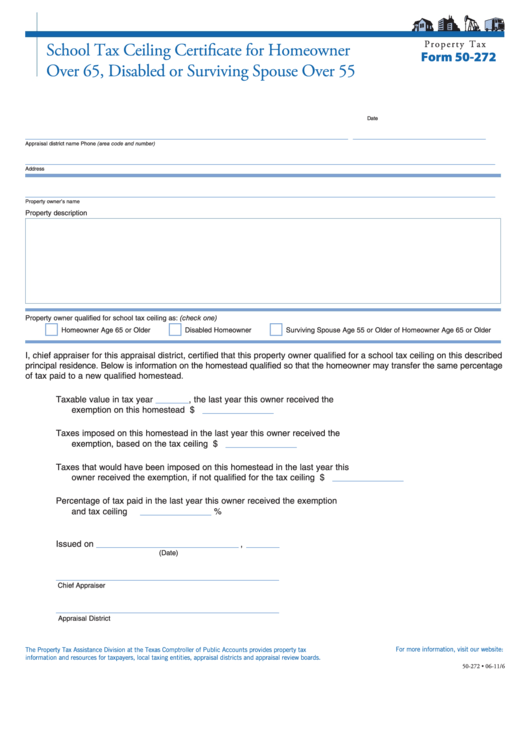

P r o p e r t y T a x

School Tax Ceiling Certificate for Homeowner

Form 50-272

Over 65, Disabled or Surviving Spouse Over 55

____________________________

Date

____________________________________________________________________

____________________________

Appraisal district name

Phone (area code and number)

___________________________________________________________________________________________________

Address

___________________________________________________________________________________________________

Property owner’s name

Property description

Property owner qualified for school tax ceiling as: (check one)

Homeowner Age 65 or Older

Disabled Homeowner

Surviving Spouse Age 55 or Older of Homeowner Age 65 or Older

I, chief appraiser for this appraisal district, certified that this property owner qualified for a school tax ceiling on this described

principal residence. Below is information on the homestead qualified so that the homeowner may transfer the same percentage

of tax paid to a new qualified homestead.

Taxable value in tax year _______, the last year this owner received the

exemption on this homestead . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_______________

Taxes imposed on this homestead in the last year this owner received the

exemption, based on the tax ceiling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

_______________

Taxes that would have been imposed on this homestead in the last year this

owner received the exemption, if not qualified for the tax ceiling . . . . . . . . . . . . .

$

_______________

Percentage of tax paid in the last year this owner received the exemption

and tax ceiling . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

_______________

%

Issued on

______________________________

,

_______

(Date)

_______________________________________________

Chief Appraiser

_______________________________________________

Appraisal District

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-272 • 06-11/6

1

1