b.

54-103

PRINT FORM

CLEAR FORM

(Rev.5-10/6)

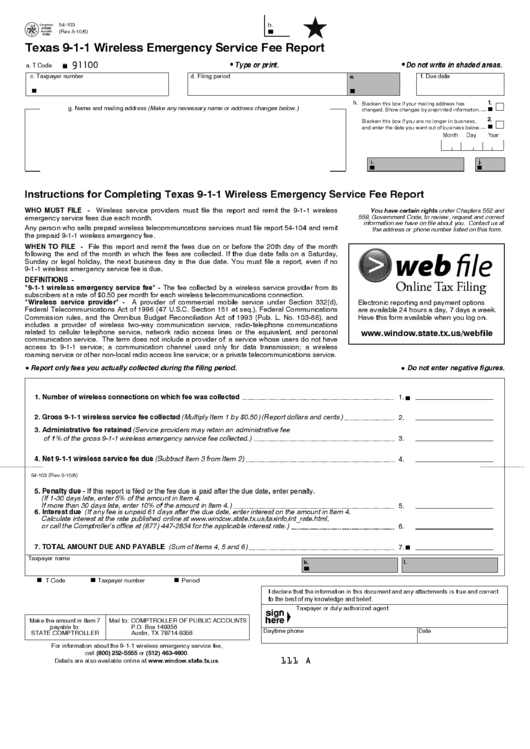

Texas 9-1-1 Wireless Emergency Service Fee Report

91100

a. T Code

Type or print.

Do not write in shaded areas.

c. Taxpayer number

d. Filing period

f. Due date

e.

h.

Blacken this box if your mailing address has

1.

g. Name and mailing address (Make any necessary name or address changes below.)

changed. Show changes by preprinted information.

Blacken this box if you are no longer in business,

2.

and enter the date you went out of business below.

Month

Day

Year

i.

j.

Instructions for Completing Texas 9-1-1 Wireless Emergency Service Fee Report

WHO MUST FILE -

Wireless service providers must file this report and remit the 9-1-1 wireless

You have certain rights under Chapters 552 and

emergency service fees due each month.

559, Government Code, to review, request and correct

information we have on file about you. Contact us at

Any person who sells prepaid wireless telecommuncations services must file report 54-104 and remit

the address or phone number listed on this form.

the prepaid 9-1-1 wireless emergency fee.

WHEN TO FILE -

File this report and remit the fees due on or before the 20th day of the month

following the end of the month in which the fees are collected. If the due date falls on a Saturday,

Sunday or legal holiday, the next business day is the due date. You must file a report, even if no

9-1-1 wireless emergency service fee is due.

DEFINITIONS

"9-1-1 wireless emergency service fee" -

The fee collected by a wireless service provider from its

subscribers at a rate of $0.50 per month for each wireless telecommunications connection.

"Wireless service provider" -

A provider of commercial mobile service under Section 332(d),

Electronic reporting and payment options

Federal Telecommunications Act of 1996 (47 U.S.C. Section 151 et seq.), Federal Communications

are available 24 hours a day, 7 days a week.

Commission rules, and the Omnibus Budget Reconciliation Act of 1993 (Pub. L. No. 103-66), and

Have this form available when you log on.

includes a provider of wireless two-way communication service, radio-telephone communications

related to cellular telephone service, network radio access lines or the equivalent, and personal

communication service. The term does not include a provider of: a service whose users do not have

access to 9-1-1 service; a communication channel used only for data transmission; a wireless

roaming service or other non-local radio access line service; or a private telecommunications service.

Report only fees you actually collected during the filing period.

Do not enter negative figures.

1. Number of wireless connections on which fee was collected

1.

2. Gross 9-1-1 wireless service fee collected

(Multiply Item 1 by $0.50) (Report dollars and cents)

2.

3. Administrative fee retained

(Service providers may retain an administrative fee

of 1% of the gross 9-1-1 wireless emergency service fee collected.)

3.

4. Net 9-1-1 wireless service fee due

(Subtract Item 3 from Item 2)

4.

54-103 (Rev.5-10/6)

5. Penalty due -

If this report is filed or the fee due is paid after the due date, enter penalty.

(If 1-30 days late, enter 5% of the amount in Item 4.

If more than 30 days late, enter 10% of the amount in Item 4.)

5.

6. Interest due

(If any fee is unpaid 61 days after the due date, enter interest on the amount in Item 4.

Calculate interest at the rate published online at ,

or call the Comptroller's office at (877) 447-2834 for the applicable interest rate.)

6.

7. TOTAL AMOUNT DUE AND PAYABLE

(Sum of Items 4, 5 and 6)

7.

Taxpayer name

k.

l.

T Code

Taxpayer number

Period

I declare that the information in this document and any attachments is true and correct

to the best of my knowledge and belief.

Taxpayer or duly authorized agent

Make the amount in Item 7

Mail to: COMPTROLLER OF PUBLIC ACCOUNTS

payable to:

P.O. Box 149356

Daytime phone

Date

STATE COMPTROLLER

Austin, TX 78714-9356

For information about the 9-1-1 wireless emergency service fee,

call

or

.

(800) 252-5555

(512) 463-4600

111 A

Details are also available online at

.

true

1

1