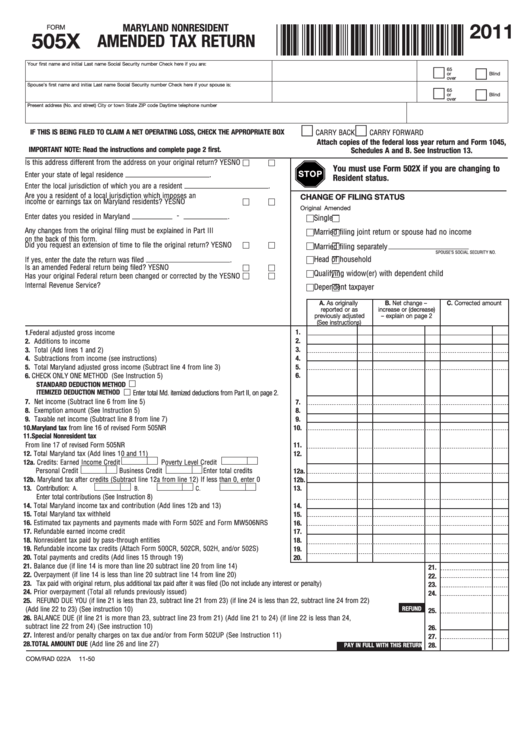

2011

MARYLAND NONRESIDENT

FORM

505X

AMENDED TAX RETURN

11505X050

Your first name and initial

Last name

Social Security number

Check here if you are:

65

or

Blind

over

Spouse’s first name and initia

Last name

Social Security number

Check here if your spouse is:

l

65

or

Blind

over

Present address (No. and street)

City or town

State

ZIP code

Daytime telephone number

IF THIS IS BEING FILED TO CLAIM A NET OPERATING LOSS, CHECK THE APPROPRIATE BOX

CARRY BACK

CARRY FORWARD

Attach copies of the federal loss year return and Form 1045,

IMPORTANT NOTE: Read the instructions and complete page 2 first.

Schedules A and B. See Instruction 13.

Is this address different from the address on your original return?

YES

NO

You must use Form 502X if you are changing to

STOP

Enter your state of legal residence _______________________ .

Resident status.

Enter the local jurisdiction of which you are a resident _______________________ .

CHANGE OF FILING STATUS

Are you a resident of a local jurisdiction which imposes an

income or earnings tax on Maryland residents?

YES

NO

Original Amended

Enter dates you resided in Maryland ___________ - ____________ .

Single

Any changes from the original filing must be explained in Part III

Married filing joint return or spouse had no income

on the back of this form .

Did you request an extension of time to file the original return?

YES

NO

Married filing separately _____________________

SPOUSE’S SOCIAL SECURITY NO .

If yes, enter the date the return was filed _______________________ .

Head of household

Is an amended Federal return being filed?

YES

NO

Qualifying widow(er) with dependent child

Has your original Federal return been changed or corrected by the

YES

NO

Internal Revenue Service?

Dependent taxpayer

A. As originally

B. Net change –

C. Corrected amount

reported or as

increase or (decrease)

previously adjusted

– explain on page 2

(See instructions)

1.

1

.

Federal adjusted gross income

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.

2. Additions to income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

3. Total (Add lines 1 and 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4. Subtractions from income (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

5.

5. Total Maryland adjusted gross income (Subtract line 4 from line 3) . . . . . . . . . . . . . . . . . .

6. CHECK ONLY ONE METHOD (See Instruction 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6.

STANDARD DEDUCTION METHOD

ITEMIZED DEDUCTION METHOD

Enter total Md . itemized deductions from Part II, on page 2 .

7. Net income (Subtract line 6 from line 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Exemption amount (See Instruction 5) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

9. Taxable net income (Subtract line 8 from line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

10. Maryland tax from line 16 of revised Form 505NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10.

11. Special Nonresident tax

11.

From line 17 of revised Form 505NR . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Total Maryland tax (Add lines 10 and 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12.

12a. Credits: Earned Income Credit

Poverty Level Credit

12a.

Personal Credit

Business Credit

Enter total credits . . . . . . . . .

12b. Maryland tax after credits (Subtract line 12a from line 12) If less than 0, enter 0 . . . . . . .

12b.

13. Contribution:

13.

A .

B .

C .

Enter total contributions (See Instruction 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Total Maryland income tax and contribution (Add lines 12b and 13) . . . . . . . . . . . . . . . . . .

14.

15. Total Maryland tax withheld . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15.

16. Estimated tax payments and payments made with Form 502E and Form MW506NRS . . . .

16.

17. Refundable earned income credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17.

18. Nonresident tax paid by pass-through entities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18.

19. Refundable income tax credits (Attach Form 500CR, 502CR, 502H, and/or 502S) . . . . . . . .

19.

20. Total payments and credits (Add lines 15 through 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20.

21. Balance due (if line 14 is more than line 20 subtract line 20 from line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21.

22. Overpayment (if line 14 is less than line 20 subtract line 14 from line 20) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22.

23. Tax paid with original return, plus additional tax paid after it was filed (Do not include any interest or penalty) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

23.

24. Prior overpayment (Total all refunds previously issued) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

24.

25. REFUND DUE YOU (if line 21 is less than 23, subtract line 21 from 23) (if line 24 is less than 22, subtract line 24 from 22)

REFUND

(Add line 22 to 23) (See instruction 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

25.

26. BALANCE DUE (if line 21 is more than 23, subtract line 23 from 21) (Add line 21 to 24) (if line 22 is less than 24,

subtract line 22 from 24) (See instruction 10) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

26.

27. Interest and/or penalty charges on tax due and/or from Form 502UP (See Instruction 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

27.

28. TOTAL AMOUNT DUE (Add line 26 and line 27) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

28.

PAY IN FULL WITH THIS RETURN

COM/RAD 022A

11-50

1

1 2

2