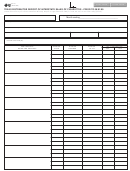

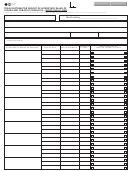

Form 69-109 (Back)(Rev.7-09/3)

INSTRUCTIONS FOR COMPLETING

TEXAS DISTRIBUTOR RECEIVING RECORD OF CIGARETTE TAX STAMPS

Under Ch. 559, Government Code, you are entitled to review, request and correct information we have on file about you, with limited

exceptions in accordance with Ch. 552, Government Code. To request information for review or to request error correction, contact us at

the address or phone numbers listed on this form.

GENERAL INFORMATION

Who Must File: T exas cigarette distributors who purchase cigarettes from a manufacturer and affix the Texas cigarette tax stamp to the

package(s) of cigarettes.

When to File: Mail the receiving record of cigarette tax stamps form(s) along with your Texas Distributor Monthly Report of Cigarettes

and Stamps (Form 69-100) for the same filing period on or before the due date listed on Form 69-100.

SPECIFIC INSTRUCTIONS

Item a - Taxpayer number - Enter your 11-digit taxpayer number as shown in Item c of the Texas Distributor Monthly Report of Cigarettes

and Stamps.

Item c - Filing period - Enter the report filing period. The filing period should be the same as the filing period shown in Item d of your Texas

Distributor Monthly Report of Cigarettes and Stamps to which this receiving record of cigarette tax stamps form is attached.

Item d - Taxpayer name - Enter your entity/taxpayer name as shown in Item g of your Texas Distributor Monthly Report of Cigarettes and

Stamps.

Item e - Physical address of permitted location - Enter the physical address of your cigarette tax permitted location. Do not use a rural

route or P.O. Box.

Item 1 - Received date - Enter the date the cigarette tax stamps were received.

Item 2 - Registered number - Enter the article number or tracking number assigned to the package of cigarette tax stamps delivered (i.e.,

Registered Mail, P.O. Express Mail, Airborne, FedEx, etc.)

Item 3 - Invoice number - Enter the invoice number of the cigarette tax stamps identified in Items 4 and 5.

Item 4 - Number of 20’s - Enter the actual number of cigarette tax stamps received / purchased to affix to the package(s) of cigarettes that

contain 20 sticks.

Item 5 - Number of 25’s - Enter the actual number of cigarette tax stamps received / purchased to affix to the package(s) of cigarettes that

contain 25 sticks.

Item 6 - Stamp Totals - Enter the total number of stamps in Items 4 and 5.

FOR ASSISTANCE

For questions regarding Texas cigarette tax, contact the State Comptroller at (800) 862-2260 or (512) 463-3731.

1

1 2

2