AB CD

PRINT FORM

CLEAR FIELDS

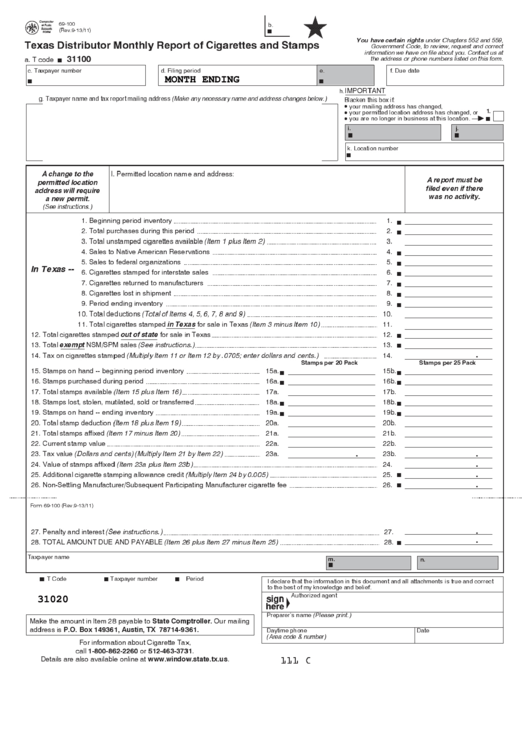

69-100

b.

(Rev.9-13/11)

b

Texas Distributor Monthly Report of Cigarettes and Stamps

under Chapters 552 and 559,

You have certain rights

Government Code, to review, request and correct

information we have on file about you. Contact us at

a. T code

31100

the address or phone numbers listed on this form.

b

c. Taxpayer number

d. Filing period

e.

f. Due date

MONTH ENDING

b

b

IMPORTANT

h.

g. Taxpayer name and tax report mailing address (Make any necessary name and address changes below.)

Blacken this box if:

your mailing address has changed,

1.

I

your permitted location address has changed, or

I

you are no longer in business at this location.

R b

I

i.

j.

b

b

k. Location number

b

A change to the

l. Permitted location name and address:

A report must be

permitted location

filed even if there

address will require

was no activity.

a new permit.

(See instructions.)

1. Beginning period inventory

1.

b

2. Total purchases during this period

2.

b

3. Total unstamped cigarettes available (Item 1 plus Item 2)

3.

4. Sales to Native American Reservations

4.

b

5. Sales to federal organizations

5.

b

6. Cigarettes stamped for interstate sales

6.

In Texas --

b

7. Cigarettes returned to manufacturers

7.

b

8. Cigarettes lost in shipment

8.

b

9. Period ending inventory

9.

b

10. Total deductions (Total of Items 4, 5, 6, 7, 8 and 9)

10.

in Texas

11. Total cigarettes stamped

for sale in Texas (Item 3 minus Item 10)

11.

out of state

12. Total cigarettes stamped

for sale in Texas

12.

b

exempt

13. Total

NSM/SPM sales (See instructions.)

13.

.

b

14. Tax on cigarettes stamped (Multiply Item 11 or Item 12 by .0705; enter dollars and cents.)

14.

Stamps per 20 Pack

Stamps per 25 Pack

15. Stamps on hand -- beginning period inventory

15a.

15b.

b

b

16. Stamps purchased during period

16a.

16b.

b

b

17. Total stamps available (Item 15 plus Item 16)

17a.

17b.

18. Stamps lost, stolen, mutilated, sold or transferred

18a.

18b.

b

b

19. Stamps on hand -- ending inventory

19a.

19b.

b

b

20. Total stamp deduction (Item 18 plus Item 19)

20a.

20b.

21. Total stamps affixed (Item 17 minus Item 20)

21a.

21b.

22. Current stamp value

22a.

22b.

.

.

23. Tax value (Dollars and cents) (Multiply Item 21 by Item 22)

23a.

23b.

.

24. Value of stamps affixed (Item 23a plus Item 23b)

24.

.

25. Additional cigarette stamping allowance credit (Multiply Item 24 by 0.005)

25.

.

b

26. Non-Settling Manufacturer/Subsequent Participating Manufacturer cigarette fee

26.

b

Form 69-100 (Rev.9-13/11)

.

27. Penalty and interest (See instructions.)

27.

.

28. TOTAL AMOUNT DUE AND PAYABLE (Item 26 plus Item 27 minus Item 25)

28.

b

Taxpayer name

m.

n.

AB

b

T Code

Taxpayer number

Period

I declare that the information in this document and all attachments is true and correct

b

b

b

to the best of my knowledge and belief.

Authorized agent

31020

Preparer's name (Please print.)

State Comptroller.

Make the amount in Item 28 payable to

Our mailing

P.O. Box 149361, Austin, TX 78714-9361.

address is

Daytime phone

Date

(Area code & number)

For information about Cigarette Tax,

1-800-862-2260

512-463-3731

call

or

.

111 C

Details are also available online at

.

1

1 2

2