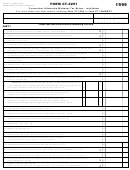

Form Ct-6251 - Connecticut Alternative Minimum Tax Return - Individuals - 2014 Page 2

ADVERTISEMENT

Part II

Complete Part II of this form only if you are required to complete Part III of federal Form 6251

24. Enter the amount from Line 11. If you are fi ling federal Form 2555 or Form 2555-EZ, enter the amount

00

from Line 3 of the Connecticut Foreign Earned Income Tax Worksheet on Page 4.

24.

00

25. Enter the amount from federal Form 6251, Line 37. See instructions.

25.

00

26. Enter the amount from federal Form 6251, Line 38. See instructions.

26.

00

27. Enter the amount from federal Form 6251, Line 39. See instructions.

27.

00

28. Enter the smaller of Line 24 or Line 27.

28.

00

29. Subtract Line 28 from Line 24.

29.

30. If Line 29 is $182,500 or less ($91,250 or less if fi ling separately), multiply Line 29 by 26% (.26).

00

Otherwise, multiply Line 29 by 28% (.28) and subtract $3,650 ($1,825 if fi ling separately) from the result.

30.

31. Enter:

$73,800, if fi ling jointly or qualifying widow(er);

$36,900, if single or fi ling separately; or

00

$49,400, if head of household.

31.

00

32. Enter the amount from federal Form 6251, Line 44. See instructions.

32.

00

33. Subtract Line 32 from Line 31. If zero or less, enter “0.”

33.

00

34. Enter the smaller of Line 24 or Line 25.

34.

00

35. Enter the smaller of Line 33 or Line 34.

35.

00

36. Subtract Line 35 from Line 34.

36.

37. Enter $406,750 if single; $228,800 if fi ling separately; $457,600 if fi ling jointly or qualifying widow(er); or

00

$432,200 if head of household.

37.

00

38. Enter the amount from Line 33.

38.

00

39. Enter the amount from federal Form 6251, Line 51. See instructions.

39.

00

40. Add Line 38 and Line 39.

40.

00

41. Subtract Line 40 from Line 37. If zero or less, enter - 0 -.

41.

00

42. Enter the smaller of Line 36 or Line 41.

42.

00

43. Multiply Line 42 by 15% (.15).

43.

00

44. Add Line 35 and Line 42.

44.

- If Line 44 and Line 24 are the same, skip Lines 45 through 49 and go to Line 50. Otherwise, go to Line 45. -

00

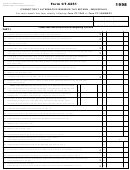

45. Subtract Line 44 from Line 34.

45.

00

46. Multiply Line 45 by 20% (.20).

46.

- If Line 26 is zero or blank, skip Lines 47 through 49 and go to Line 50. Otherwise, go to Line 47. -

00

47. Add Lines 29, 44, and 45.

47.

00

48. Subtract Line 47 from Line 24.

48.

00

49. Multiply Line 48 by 25% (.25).

49.

00

50. Add Lines 30, 43, 46, and 49.

50.

51. If Line 24 is $182,500 or less ($91,250 or less if fi ling separately), multiply Line 24 by 26% (.26).

00

Otherwise, multiply Line 24 by 28% (.28) and subtract $3,650 ($1,825 if fi ling separately) from the result.

51.

52. Enter the smaller of Line 50 or Line 51 here and on Line 12. If you are fi ling federal Form 2555 or

Form 2555-EZ, do not enter this amount on Line 12. Enter it on Line 4 of the Connecticut Foreign Earned

00

Income Worksheet on Page 4 of the instructions.

52.

Page 2 of 6

Form CT-6251 Back (Rev. 01/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6