Form Ct-6251 - Connecticut Alternative Minimum Tax Return - Individuals - 2014 Page 6

ADVERTISEMENT

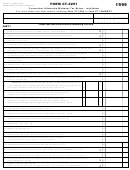

Form CT-6251 Schedule A

Schedule A - Credit for Alternative Minimum Tax Paid to Qualifying Jurisdictions

You must attach a copy of your return fi led with the qualifying jurisdiction(s) or your credit will be disallowed.

00

53. Modifi ed adjusted federal alternative minimum taxable income: See instructions.

53.

Column A

Column B

For each column, enter the following:

Name

Code

Name

Code

54. Enter qualifying jurisdiction’s name and two-letter code.

54.

55. Enter the non-Connecticut adjusted federal alternative

minimum taxable income included on Line 55 which is

00

00

subject to a qualifying jurisdiction’s alternative minimum tax.

55.

56. Divide Line 55 by Line 53. Round to four decimal places.

56.

•

•

57. Enter the net Connecticut minimum tax (from Form CT-6251,

00

00

Line 21). Part-Year Residents, see instructions below.

57.

00

00

58. Multiply Line 56 by Line 57.

58.

00

00

59. Alternative minimum tax paid to a qualifying jurisdiction: See instructions. 59.

00

00

60. Enter the lesser of Line 58 or Line 59.

60.

00

61. Total credit: Add Line 60, all columns. Enter amount here and on Line 22 on the front of this form.

61.

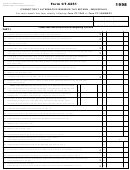

If you claim credit for alternative minimum tax paid to another state of the United States, a political subdivision within another state, or the District

of Columbia, enter the appropriate two-letter code. For a list of the standard two-letter code for each state, see Schedule 2 - Credit for Income

Taxes Paid to Qualifying Jurisdictions in the instructions to Form CT-1040 or Form CT-1040NR/PY.

Line Instructions

Line 53

Line 58

Residents: Enter the amount of adjusted federal alternative

Multiply the percentage arrived at on Line 56 by the amount

minimum taxable income from Form CT-6251, Line 5. However,

reported on Line 57.

if a taxpayer’s adjusted federal alternative minimum taxable

Line 59

income includes a net loss derived from or connected with

:

Residents

Enter the total amount of alternative minimum tax

sources in a qualifying jurisdiction(s), the taxpayer must add the

paid to a qualifying jurisdiction.

net loss to the amount of adjusted federal alternative minimum

taxable income from Line 5 and enter the result.

Part-Year Residents: Enter the amount of alternative minimum

tax paid to a qualifying jurisdiction on items of income, gain,

Part-Year Residents: Enter the portion of adjusted federal

loss, or deduction derived from or connected with sources in

alternative minimum taxable income from Form CT-6251, Line 5,

that jurisdiction during the residency portion of the taxable year.

attributable to the residency portion of the taxable year. However,

if a part-year resident’s adjusted federal alternative minimum

If the alternative minimum tax paid to that jurisdiction was

taxable income includes a net loss derived from or connected

also based on income earned during the nonresidency portion

with sources in a qualifying jurisdiction(s), the taxpayer must

of your taxable year, you must prorate the amount of tax for

add the net loss to the amount of adjusted federal alternative

which you are claiming credit. The proration is based upon the

minimum taxable income from Line 5 attributable to the residency

relationship that the income earned in that jurisdiction during

portion of the taxable year.

your Connecticut residency bears to the total amount of income

that you earned in that jurisdiction in the taxable year.

Line 54

Enter the name and the two-letter code of each qualifying

Alternative minimum tax paid means the lesser of your tax

jurisdiction to which you paid alternative minimum tax for which

liability to the qualifying jurisdiction or the tax you paid to that

you are claiming credit.

jurisdiction as reported on a return fi led with that jurisdiction, but

not any penalty or interest.

Line 55

Enter the amount of the adjusted federal alternative minimum

Line 60

taxable income included on Line 53 subject to a qualifying

Enter the lesser of the amounts reported on Line 58 or Line 59.

jurisdiction’s alternative minimum tax.

Line 61

Line 56

Add the amounts from Line 60, Column A; Line 60, Column B;

Divide the amount on Line 55 by the amount on Line 53. The

and Line 60 of any additional worksheets. The amount on

result may not exceed 1.0000. Round to four decimal places.

Line 61 cannot exceed the total of Line 58. Enter the total on

Line 61 and on Line 22.

Line 57

Residents: Enter the amount from Form CT-6251, Line 21.

Part-Year Residents: Enter the portion of the 2014 net

Connecticut minimum tax liability attributable to the residency

portion of the taxable year.

Form CT-6251 Schedule A Instructions (Rev. 01/15)

Page 6 of 6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6