Form Rev-1175 Ct - Schedule Ar Explanation For Filing Amended

ADVERTISEMENT

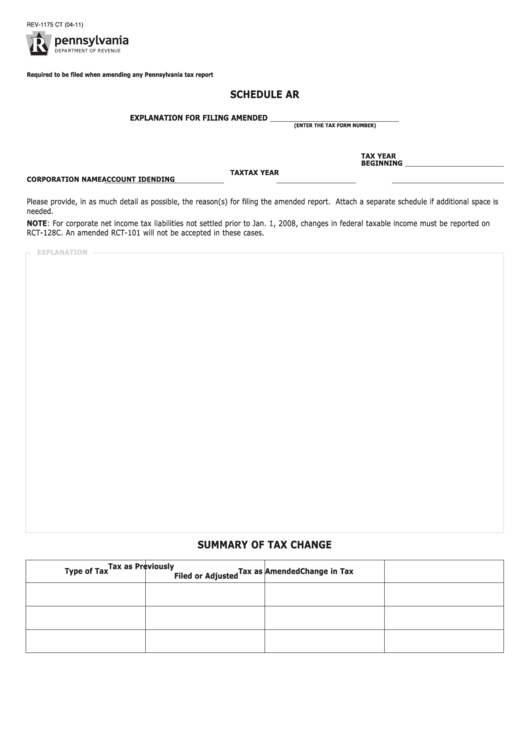

REV-1175 CT (04-11)

Required to be filed when amending any Pennsylvania tax report

SCHEDULE AR

EXPLANATION FOR FILING AMENDED

(ENTER THE TAX FORM NUMBER)

TAX YEAR

BEGINNING

TAX

TAX YEAR

CORPORATION NAME

ACCOUNT ID

ENDING

Please provide, in as much detail as possible, the reason(s) for filing the amended report. Attach a separate schedule if additional space is

needed.

NOTE: For corporate net income tax liabilities not settled prior to Jan. 1, 2008, changes in federal taxable income must be reported on

RCT-128C. An amended RCT-101 will not be accepted in these cases.

EXPLANATION

SUMMARY OF TAX CHANGE

Tax as Previously

Type of Tax

Tax as Amended

Change in Tax

Filed or Adjusted

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1