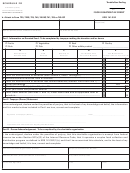

Schedule Cc (Form 41a720cc) - Coal Conversion Tax Credit Page 2

ADVERTISEMENT

Page 2

41A720CC (10-12)

*1200020223*

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

PART III—COMPUTATION OF COAL SUBSTITUTION (To be completed by a corporation that checked box D on page 1.)

1. Base year fuel input.

A

B

C

D

Number of

Million

Million

Percent of

Fuel

Unit

Units Used

BTUs/Unit

BTUs/Fuel

BTUs Used*

(Avg.)

a.

Kentucky Coal

Tons

x

=

b.

Non-Kentucky Coal

Tons

x

=

c.

Natural Gas

MCF

x

=

d.

Crude Oil

Bbls.

x

=

e.

Fuel Oil

Gals.

x

=

f.

Other:

x

=

g.

TOTAL of c, d, e and f ..........................................................................................................

100%

h.

TOTAL of a, b, c, d, e and f ..................................................................................................

*Compute percentages by dividing amounts in Column C, lines a through f, by amount in Column C, line h.

2. Tax year fuel input.

A

B

C

D

Number of

Million

Million

Percent of

Fuel

Unit

Units Used

BTUs/Unit

BTUs/Fuel

BTUs Used*

(Avg.)

a.

Kentucky Coal

Tons

x

=

b.

Non-Kentucky Coal

Tons

x

=

c.

Natural Gas

MCF

x

=

d.

Crude Oil

Bbls.

x

=

e.

Fuel Oil

Gals.

x

=

f.

Other:

x

=

g.

TOTAL of c, d, e and f ..........................................................................................................

100%

h.

TOTAL of a, b, c, d, e and f ..................................................................................................

*Compute percentages by dividing amounts in Column C, lines a through f, by amount in Column C, line h.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3