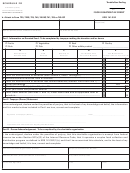

Schedule Cc (Form 41a720cc) - Coal Conversion Tax Credit Page 3

ADVERTISEMENT

Page 3

41A720CC (10-12)

*1200020224*

Commonwealth of Kentucky

DEPARTMENT OF REVENUE

PART III—COMPUTATION OF COAL SUBSTITUTION (Continued)

(To be completed by a corporation that checked box D on page 1.)

3. Enter percentage of BTUs produced by sources other than coal in base year

(from line 1g, Column D) ................................................................................................................................ 3

4. Enter percentage of BTUs produced by sources other than coal in tax year

(from line 2g, Column D) ................................................................................................................................ 4

5. Subtract line 4 from line 3. If there was no decrease in percentage of BTUs

from sources other than coal from base year to tax year, then the corporation

is not entitled to the coal credit .................................................................................................................... 5

6. Enter percentage of BTUs produced by Kentucky coal in tax year (from line 2a, Column D) .................. 6

7. Enter percentage of BTUs produced by Kentucky coal in the base year

(from line 1a, Column D) ................................................................................................................................. 7

8. Subtract line 7 from line 6. If there was no increase in percentage of BTUs

from Kentucky coal from base year to tax year, then the corporation is not

entitled to the coal credit .............................................................................................................................. 8

9. Enter million BTUs input of Kentucky coal (from line 2a, Column C) ......................................................... 9

10. Compare percentages on lines 5 and 8, and enter the lesser percentage .................................................. 10

11. Multiply amount on line 9 by percentage on line 10. Enter result here ...................................................... 11

12. Enter average million BTUs/unit (from line 2a, Column B) .......................................................................... 12

13. Divide line 11 by line 12. Enter result here .................................................................................................... 13

14. Enter average purchase price per ton (total from Part I, Column D,

divided by total from Part I, Column A) ......................................................................................................... 14

00

15. Multiply line 13 by line 14. Enter result here ................................................................................................. 15

00

16. Credit rate is 4.5% ............................................................................................................................................ 16 x

.045

17. Tax Credit: Multiply amount on line 15 by line 16 ....................................................................................... 17

00

18. LLET Credit—Enter appropriate amount from line 17 on Schedule TCS, Part II, Column E ..................... 18

00

19. Corporation Income Tax Credit—Enter appropriate amount from line 17 on Schedule TCS,

Part II, Column F .............................................................................................................................................. 19

00

(NOTE: This credit cannot reduce the LLET below the $175 minimum.)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3