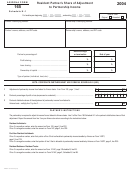

MMDDYYYY

REV-961 CT (05-11)

TAX YEAR

BEGINNING

TAX

TAX YEAR

CORPORATION NAME

ACCOUNT ID

ENDING

SCHEDULE A-3

ADJUSTMENTS TO NET INCOME PER BOOKS

(See CT-1 booklet at for requirements to complete this schedule)

PART A

1. Net Income per Books from federal

Schedule M-1 or federal Schedule M-3.

Additions

Reductions

2. Dividends from subsidiary corporations

8. Income from subsidiary corporations

not included in Line 1

included in Line 1

3. Losses from subsidiary corporations

9. Income from Limited Liability Companies

deducted in arriving at Line 1

included in Line 1*

4. Losses from Limited Liability Companies

10. Distributions to Materially Participating

deducted in arriving at Line 1*

Member of Limited Liability Companies**

5. Distributions from Limited Liability

11. Other (Itemize)

Companies not included in Line 1*

6. Other (Itemize)

12. Total Lines 8 to 11

13. Revised Net Income per Books

7. Total Lines 1 to 6

(Line 7 minus Line 12)

*

Any taxpayer making these adjustments must provide a copy of federal Schedule K-1, if the investee LLC files federal Form

1065, or a reconciliation of beginning and ending net worth of the investee LLC, if the investee LLC is a disregarded entity.

** This reduction may only be taken by LLCs and Business Trusts not taxed as corporations for federal income tax purposes. Taxpayers

claiming this reduction must complete Part B below.

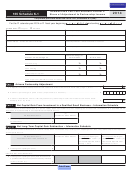

PART B

Name of Member

Current-Year Distribution

Less Current-Year Distribution included

SSN or EIN of Member

in Prior-Year Reduction

How does member qualify as materially participating under IRC Section 469?

Plus Current-Year Reduction distributed

in subsequent year

Current-Year Reduction

Name of Member

Current-Year Distribution

SSN or EIN of Member

Less Current-Year Distribution included

in Prior-Year Reduction

How does member qualify as materially participating under IRC Section 469?

Plus Current-Year Reduction distributed

in subsequent year

Current-Year Reduction

Name of Member

Current-Year Distribution

SSN or EIN of Member

Less Current-Year Distribution included

in Prior-Year Reduction

How does member qualify as materially participating under IRC Section 469?

Plus Current-Year Reduction distributed

in subsequent year

Current-Year Reduction

Total Reduction from Supplemental Schedule (Attach additional schedule(s) if necessary) . . . . . . . . . . . . . . . . . . . . . .

Total Reduction for Distributions to Materially Participating Members (carry to Part A - Line 10) . . . . . . . . . . . . . . . . . .

PRINT FORM

Reset Entire Form

RETURN TO TOP

RETURN TO PAGE ONE

1

1 2

2