#1695#

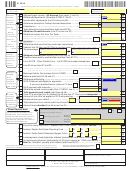

2012 Form 511NR - Nonresident/Part-Year Income Tax Return - Page 2

Name(s) shown

Your Social

on Form 511NR:

Security Number:

Adjusted gross income: All Sources (from page 1, line 24) ..................................

00

25

Oklahoma

25

Standard

26

NR-C

Oklahoma Adjustments (Schedule 511NR-C, line 8) ...............................................

26

00

Deduction:

27

00

Income after adjustments (line 25 minus line 26) ....................................................

27

• Single or

28

00

Oklahoma standard or Federal itemized deductions .........

28

Married Filing

29

00

Exemptions

....

29

($1,000 x number of exemptions claimed on page 1)

Separate:

30

00

Total deductions and exemptions (add lines 28-29) ................................................

$5,950

30

Oklahoma Taxable Income: (line 27 minus line 30) ..............................................

31

00

31

• Married

32

Filing Joint

Oklahoma Income Tax from Tax Table.....................................................................

32

or Qualifying

If using Farm Income Averaging, enter tax from Form 573, line 22 and enter a “1” in box.

Widow(er):

If paying the Health Savings Account additional 10% tax, add additional tax here and enter a “2” in box.

00

STOP AND READ: If line 24 is equal to or larger than line 19, complete line 33. If line 24 is smaller than line 19, see Schedule 511NR-D.

$11,900

• Head of

33

NR-D

Oklahoma child care/child tax credit (see instructions) ...........................................

33

00

Household:

(Do not enter less than zero)

34

Subtract line 33 from line 32 (This is your tax base)

....

34

00

$8,700

Oklahoma Amount (from line 23)

Federal Amount (from line 24)

•

35

Tax percentage:

a)

b)

•

%

35

Itemized

Oklahoma Income Tax. Multiply line 34 by line 35 ................................................

00

36

36

Deductions:

37

00

Credit for taxes paid to another state (enclose Form 511TX)

37

nonresidents do not qualify

Enclose a

copy of the

38

Form 511CR - Other Credits Form -

List 511CR line number claimed here:

38

00

Federal

(Do not enter less than zero)

Schedule

Line 36 minus lines 37 and 38 .................................

..

39

39

00

.

Use tax due on Internet, mail order, or other out-of-state purchases while living in Oklahoma

40

40

00

If you certify that no use tax is due, place an ‘X’ here:

If filing an

Business Activity Tax (enclose Form 511-BAT) .......................................................

41

41

00

amended

42

Balance (add lines 39, 40 and 41) ...........................................................................

00

42

return,

(enclose W-2s, 1099s or withholding statement) .

43

Oklahoma withholding

complete

43

00

WORKSHEET

2012 Oklahoma estimated tax payments ..........................

worksheet

44

44

If you are a qualified farmer, place an ‘X’ here:

on page 4 of

00

Form 511NR.

45

2012 payment with extension ............................................

45

00

46

NR-E

Oklahoma earned income credit (Sch. 511NR-E, line 4) ...

46

00

Total payments and credits (add lines 43-46) ......................................................

47

47

00

If line 47 is more than line 42, subtract line 42 from line 47. This is your overpayment .

For further

48

48

00

information

Amount of line 48 to be applied to 2013 estimated tax .....

49

49

00

regarding

Donations from your refund

..

50

50

(Sch. 511NR-F, line 20)

NR-F

RESET NR-F

00

estimated tax,

see page 4 of

51

Total deductions from refund (add lines 49 and 50) ................................................

00

51

511NR Packet.

Amount to be refunded (line 48 minus line 51).......................................................

52

52

00

Direct Deposit Note:

Is this refund going to or through an account that is located outside of the United States?

Yes

No

Deposit my refund in my:

For Direct Deposit Information see the

511NR Packet. If you do not have your

Routing

checking account

refund deposited directly into your bank

Number:

account, you will receive a debit card.

Account

For debit card information see “All About

savings account

Number:

Refunds” in the 511NR Packet.

If line 42 is more than line 47, subtract line 47 from line 42. This is your tax due ...

53

53

00

Donation: Eastern Red Cedar Revolving Fund ........

$2

$5

$________

54

54

00

55

Donation: Public School Classroom Support Fund ..

$2

$5

$________

55

00

56

00

Underpayment of estimated tax interest (annualized installment method

) .

56

57

00

For delinquent payment (add penalty of 5% plus interest at 1.25% per month) .

57

Total tax, donation, penalty and interest (add lines 53-57) ................................

58

00

58

Under penalty of perjury, I declare the information contained in this document, and all

Place an ‘X’ in this box if the Oklahoma Tax Commission

attachments and schedules, is true and correct to the best of my knowledge and belief.

may discuss this return with your tax preparer..................

Taxpayer’s signature

Date

Spouses’s signature

Date

Paid Preparer’s signature

Date

Paid Preparer’s address and phone number

Taxpayer’s occupation

Spouse’s occupation

A COPY OF FEDERAL RETURN

Daytime Phone Number (optional)

MUST BE PROVIDED.

Paid Preparer’s PTIN

Please remit to: Oklahoma Tax Commission, P.O. Box 26800, Oklahoma City, OK 73126-0800

1

1 2

2 3

3 4

4 5

5 6

6