#1695#

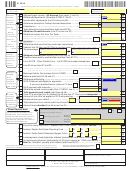

2012 Form 511NR - Nonresident/Part-Year Income Tax Return - Page 4

NOTE: Enclose this page ONLY if you have an amount shown on a schedule.

Name(s) shown

Your Social

on Form 511NR:

Security Number:

Child Care/Child Tax Credit

Schedule 511NR-D

See instructions for details on qualifications

and required enclosures.

If your Federal Adjusted Gross Income is $100,000 or less and you are allowed either a credit for child care expenses or the child tax

credit on your Federal return, then as a resident, part-year resident or nonresident military, you are allowed a credit against your Okla-

homa tax. Your Oklahoma credit is the greater of:

• 20% of the credit for child care expenses allowed by the IRS Code.

Your allowed Federal credit cannot exceed the amount of your Federal tax reported on your Federal return.

or

• 5% of the child tax credit allowed by the IRS Code.

This includes both the nonrefundable child tax credit and the refundable additional child tax credit.

The credit must be prorated based on the ratio of Oklahoma Adjusted Gross Income to Federal Adjusted Gross Income.

If your Federal Adjusted Gross Income is greater than $100,000, no credit is allowed.

Enclose a copy of your Federal return and, if applicable, the Federal child care credit schedule.

BACK TO PAGE 2

Enter your Federal child care credit ..............................

00

1

1

2

00

Multiply line 1 by 20% ....................................................

2

Enter your Federal child tax credit

3

00

(total of child tax credit & additional child tax credit)......

3

00

4

Multiply line 3 by 5% ......................................................

4

00

5

Enter the larger of line 2 or line 4 ...................................................................................

5

6

Divide the amount on line 24 of Form 511NR by the amount on line 19 of Form 511NR

•

•

%

(do not enter more than 100%)

Enter the percentage from the above calculation here

........

6

7

Multiply line 5 by line 6. This is your Oklahoma child care/child tax credit.

00

Enter total here and on Form 511NR, line 33 .................................................................

7

Earned Income Credit

Schedule 511NR-E

See instructions for details on qualifications

and required enclosures.

Residents and part-year residents are allowed a credit equal to 5% of the Earned Income Credit allowed on the Federal return.

The credit must be prorated on the ratio of Oklahoma source AGI to Federal AGI. Enclose a copy of your Federal return.

Nonresidents do not qualify.

BACK TO PAGE 2

1

Federal earned income credit ........................................................................................

00

1

2

00

Multiply line 1 by 5% ......................................................................................................

2

3

Divide the amount on line 23 of Form 511NR by the amount on line 19 of Form 511NR

•

•

%

(do not enter more than 100%)

Enter the percentage from the above calculation here

.......

3

4

Oklahoma earned income credit....................................................................................

4

00

(multiply line 2 by line 3, enter total here and on line 46 of Form 511NR)

Worksheet for Amended Returns Only

(Form 511NR, Page 2, Line 43)

When amending Form 511NR you must adjust Form 511NR, line 43 (Oklahoma Income Tax Withheld) by

subtracting any previous overpayments or adding any tax previously paid. Use worksheet below.

BACK TO PAGE 2

00

1. Oklahoma income tax withheld

2. Amount paid with the original return plus additional paid after it was filed

00

(Do not include payments of underpayment of estimated tax interest)

00

3. Add lines 1 and 2

00

4. Overpayment, if any, shown on original return or as previously adjusted by Oklahoma

00

5. Subtract line 4 from line 3. Enter here and on line 43 of the amended Form 511NR

1

1 2

2 3

3 4

4 5

5 6

6