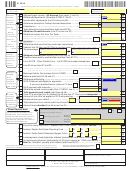

2012 Form 511NR - Nonresident/Part-Year Income Tax Return - Page 6

NOTE: Do NOT enclose this page with Form 511NR.

Schedule 511NR-F: Information

5- Oklahoma Pet Overpopulation Fund

12- Support Oklahoma Honor Flights

You may donate from your tax refund for the benefit of the Oklahoma Pet

You have the opportunity to donate any amount of your tax refund to sup-

Overpopulation Fund. Monies placed in this fund will be expended for the

port Oklahoma Honor Flights. Oklahoma Honor Flights is a 501(c)(3) not-

for-profit organization that transports Oklahoma World War II veterans to

purpose of developing educational programs on pet overpopulation and

for implementing spay/neuter efforts in this state. If you are not receiv-

Washington, D.C. to visit the memorial dedicated to honor their service

and sacrifice. If you are not receiving a refund, you may still donate. Mail

ing a refund, you may still donate. Mail your contribution to: Oklahoma

Department of Agriculture, Food and Forestry, Animal Industry Division,

your contribution to: Oklahoma Honor Flights, P.O. Box 10492, Midwest

2800 North Lincoln Blvd., Oklahoma City, OK 73105.

City, OK 73140.

13- Eastern Red Cedar Revolving Fund

6- Support of the Oklahoma National Guard

You have the opportunity to donate from your tax refund for the benefit of

Help stimulate rural development, improve public health and enhance

providing financial relief to qualified members of the Oklahoma National

wildlife habitat by donating to the Eastern Red Cedar Revolving Fund.

The Fund was established to promote the harvesting and utilization of

Guard and their families. Donations will be placed in the Income Tax

eastern red cedar trees and to promote the marketing, research and edu-

Checkoff Revolving Fund for the Support of the Oklahoma National

cation efforts concerning the tree and eastern red cedar products. Monies

Guard Relief Program. Monies, to assist Oklahoma National Guard

donated may be expended by the State Board of Agriculture as directed

members and their families with approved hardship expenses, will be ex-

by the Eastern Red Cedar Registry Board. You can also mail a contribu-

pended by the Military Department. If you are not receiving a refund, you

tion to: Eastern Red Cedar Revolving Fund, Oklahoma Department of

may still donate. Please mail your contribution to: Operation Homefront

Agriculture, Food and Forestry, 2800 North Lincoln Boulevard, Oklahoma

Task Force, 3501 Military Circle, Oklahoma City, OK 73111-4398.

City, OK 73105.

7- Oklahoma Leukemia and Lymphoma Fund

14- Support of Domestic Violence and Sexual Assault Services

You have the opportunity to donate from your tax refund for the benefit of

You may donate from your tax refund for the benefit of domestic violence

the Oklahoma Leukemia and Lymphoma Revolving Fund. Monies from

and sexual assault services in Oklahoma that have been certified by

the fund will be used by the State Department of Health for the purpose of

the Attorney General. Your donation will be used to provide grants to

supporting voluntary health agencies dedicated to curing Leukemia, Lym-

phoma, Hodgkin’s Disease, and Myeloma and to improving the quality of

domestic violence and sexual assault service providers for the purpose

of providing domestic violence and sexual assault services in Oklahoma.

life of patients and their families. If you are not receiving a refund, you

The term “services” includes but is not limited to programs, shelters or

may still donate. Please mail your contribution to: State Department of

a combination thereof. If you are not receiving a refund, you may still

Health, Oklahoma Leukemia and Lymphoma Revolving Fund - 228, P.O.

donate. Mail your contribution to: Attorney General, Domestic Violence

Box 268823, Oklahoma City, OK 73152-8823.

and Sexual Assault Services Fund, 313 NE 21st Street, Oklahoma City,

8- Support of Programs for Regional Food Banks

OK 73105.

in Oklahoma

15- Support of Volunteer Fire Departments

You may donate from your tax refund for the benefit of the Regional Food

You may donate from your tax refund for the benefit of volunteer fire

Bank of Oklahoma and the Community Food Bank of Eastern Oklahoma

departments in Oklahoma. Your donation will be used to provide grants to

(Oklahoma Food Banks). The Oklahoma Food Banks are the largest

volunteer fire departments in this state for the purpose of purchasing bun-

hunger-relief organizations in the state - distributing food to charitable and

ker gear, wildland gear and other protective clothing. If you are not receiv-

faith-based feeding programs throughout all 77 counties in Oklahoma.

ing a refund, you may still donate. Mail your contribution to: Oklahoma

Your donation will be used to help provide food to the more than 500,000

State Fire Marshal, Attn: Volunteer Fire Department Fund, 2401 NW 23rd

Oklahomans at risk of hunger on a daily basis. If you are not receiving

Street, Suite 4, Oklahoma City, OK 73107.

a refund, you may still donate by mailing your contribution to: Oklahoma

16- Oklahoma Lupus Revolving Fund

Department of Human Services, Revenue Processing Unit, Re: Programs

You may donate from your refund for the benefit of the Oklahoma Lupus

for OK Food Banks, P.O. Box 248893, Oklahoma City, OK 73124.

9- Support of Folds of Honor Scholarship Program

Revolving Fund. Monies from the fund will be used by the State Depart-

ment of Health to provide grants to the Oklahoma Medical Research

You have the opportunity to donate from your tax refund to support the

Foundation for the purpose of funding research into treating and curing

Folds of Honor Foundation. Folds of Honor is a 501(c)(3) charitable orga-

lupus in this state. If you are not receiving a refund, you may still donate.

nization that provides post-secondary educational scholarships for chil-

Mail your contribution to: State Department of Health, Lupus Revolving

dren and spouses of military service men and women killed or disabled

Fund, P.O. Box 268823, Oklahoma City, OK 73152-8823.

while serving in the war in Iraq or Afghanistan. If you are not receiving

17- Oklahoma Sports Eye Safety Program

a refund, you may still donate. Mail your contribution to: Folds of Honor

You may donate from your refund for the benefit of the Oklahoma Sports

Foundation, 5800 North Patriot Drive, Owasso, OK 74055.

10- Y.M.C.A. Youth and Government Program

Eye Safety Program. Your donation will be used by the State Department

of Health to establish a sports eye safety grant program for the purchase

You have the opportunity to donate from your tax refund for the benefit of

and distribution of sports eye safety programs and materials to Okla-

the Oklahoma chapter of the Y.M.C.A. Youth and Government program.

homa classrooms and sports eye safety protective wear to children age

Monies donated will be expended by the State Department of Education

18 and under. Monies will also be used to explore opportunities to utilize

for the purpose of providing grants to the Program so young people may

nonprofit organizations to provide such safety information or equipment.

be educated regarding government and the legislative process. If you

If you are not receiving a refund, you may still donate. Mail your contribu-

are not receiving a refund, you may still donate. Mail your contribution to:

tion to: State Department of Health, Sports Eye Safety Fund, P.O. Box

Oklahoma State Department of Education, Y.M.C.A. Youth and Govern-

268823, Oklahoma City, OK 73152-8823.

ment Program, Office of the Comptroller, 2500 North Lincoln Boulevard,

18 - Historic Greenwood District Music Festival Fund

Room 415, Oklahoma City, OK 73105-4599.

With part of your tax refund you can support music festivals in the Historic

11- Multiple Sclerosis Society Fund

Greenwood District of Tulsa. Your donation will be used by the Oklahoma

You may donate for the benefit of research toward a cure for Multiple

Historical Society to assist with music education, public concerts, and a

Sclerosis. Your donation will be placed in a fund for the purpose of provid-

celebration of Tulsa’s and Oklahoma’s musical heritage. You may also

ing grants to the Multiple Sclerosis Society for purposes of mobilizing

mail your contributions to: Greenwood District Music Festival Fund, Okla-

people and resources to drive research for a cure and to address the

homa Historical Society, 800 Nazih Zuhdi Dr., Oklahoma City, OK 73105.

challenges of everyone affected by multiple sclerosis. If you are not

19 - Public School Classroom Support Fund

receiving a refund, you may still donate. Mail your contribution to: Okla-

Donations to the Public School Classroom Support Revolving Fund will

homa State Department of Health, Multiple Sclerosis Society Revolving

be used by the State Board of Education to provide one or more grants

Fund, P.O. Box 268823, Oklahoma City, OK 73126-8823.

annually to public school classroom teachers. Grants will be used by the

classroom teacher for supplies, materials, or equipment for the class or

classes taught by the teacher. Grant applications will be considered on a

statewide competitive basis. You may also mail a donation to: Oklahoma

State Board of Education, Public School Classroom Support Fund, Office

of the Comptroller, 2500 North Lincoln Boulevard, Room 415, Oklahoma

City, OK 73105-4599.

1

1 2

2 3

3 4

4 5

5 6

6