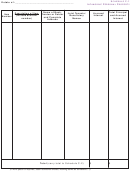

Schedule E

Estate of: _____________________________________

Transfer During Lifetime

Name and

Legal Description

Value at Date

Date

Alternate

Item

Address

or Character

of Death

of

Value

Number

of Transferee.

of Transferred Property

(2)

Transfer

(1)

Relationship

to Decedent

$

$

Total

(If more space is required, attach additional sheets, marking same as Schedule E)

Total Schedule E (column 1 or 2 as applicable) (carry to line 5 on “Summary of Schedules”)...................... $ ___________

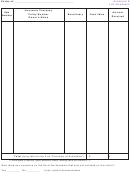

Yes

No

Has the decedent filed federal gift tax returns (form 709) within the last three (3) years?

. .........................................................................................................................

If yes, submit copies

Section I - Right or Interest Retained

Did the decedent at anytime make a transfer, by trust or otherwise, which was not a bona fide sale

for an adequate consideration in money or money’s worth in which:

A. The decedent retained a life estate? ...........................................................................................

B. Possession or enjoyment of the property through ownership can be obtained only by

surviving the decedent and the decedent retained a reversionary interest? ...................................

C. The decedent retained the power, alone or in conjunction with any other person to

? .......................................................................

alter, amend, revoke, or terminate the transfer

Section II - Contemplation of Death

Did the decedent within three (3) years immediately preceding death, by trust or otherwise, for less

than an adequate consideration in money or money’s worth:

A. Transfer an interest in property? ....................................................................................................

B. Relinquish a power? ......................................................................................................................

C. Exercise a general power of appointment? ...................................................................................

If the answer to any of the above questions is “yes”, furnish the above information to each transfer.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35