Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Tax Commission

Oklahoma Estate Tax Return

2501 Lincoln Boulevard

2501 Lincoln Boulevard

2501 Lincoln Boulevard

2501 Lincoln Boulevard

2501 Lincoln Boulevard

Oklahoma City, OK 73194

Oklahoma City, OK 73194

Oklahoma City, OK 73194

Oklahoma City, OK 73194

Oklahoma City, OK 73194

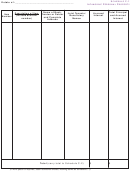

Instructions for Schedule F

Instructions for Schedule F

Instructions for Schedule F

Instructions for Schedule F

Instructions for Schedule F

Property Having a Taxable Situs Outside the State of Oklahoma:

List total gross value of all real estate, or any interest therein, and all personal property having a

taxable situs outside the State of Oklahoma. Debts and mortgages should be listed under deduction,

Schedule G.

A statement of the value of the property located outside the State is required only for the purpose

of arriving at the percentage of deduction and exemption allowed by statute in computing tax liability

of the Oklahoma estate.

All intangible personal property of the decedent follows domicile of the decedent and is taxable

there.

All other property is taxable based upon its physical location.

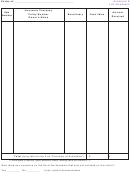

Instructions for Schedule G

Instructions for Schedule G

Instructions for Schedule G

Instructions for Schedule G

Instructions for Schedule G

Debts, Mortgages, and Taxes Due and Unpaid at Death:

Debts should be decreased by any amount paid by credit life insurance. Any excess of credit life

insurance should be listed on Schedule D.

All medical debts should be decreased by any amount covered by Medicare or health insurance.

List all valid debts of the decedent due and owing at the date of death.

Only property taxes owed on Oklahoma real estate which have been assessed before decedent’s

death are deductible on the Oklahoma tax return.

Only unpaid Federal gift taxes on gifts made by the decedent are deductible.

Federal and State estate taxes and interest and penalty on the decedent’s estate are not

deductible.

Any debt claimed on the estate tax return, upon which the decedent was a co-signer, must have a

corresponding asset shown in the estate as a claim against the original party of the note.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35