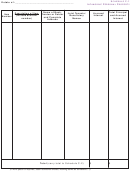

O

T

KLAHOMA

ABLE

Based on American Experience Table with interest at 5%.

Table for Computing Life Estates and Terms of Years for Purpose of Taxation.

Prepared by the Oklahoma Estate Section of the Oklahoma Tax Commission.

1

4

1

2

3

1

4

2

3

81

4.05

3.01349

19.615673

91

1.19

.64497

19.764055

82

3.71

2.76062

19.633974

92

.98

.44851

19.775290

83

3.39

2.51052

19.651404

93

.80

.28761

19.785990

84

3.08

2.26066

19.668004

94

.64

.13605

19.796181

85

2.77

2.00986

19.683813

95

...

...

19.805886

86

2.47

1.76061

19.698869

96

...

...

19.815129

87

2.18

1.51750

19.713208

97

...

...

19.823932

88

1.91

1.28611

19.726865

98

...

...

19.832316

89

1.66

1.06704

19.739871

99

...

...

19.840301

90

1.42

.85453

19.752258

100

...

...

19.847905

The following correcting factors should be added to the annuity factor set forth under column 3:

(a) If payable semi-annually ................................................................................ .250

(b) If payable quarterly ........................................................................................ .375

(c) If payable monthly ......................................................................................... .45833

E

U

T

XAMPLES OF THE

SE OF THE

ABLES. - A will gives to the widow an estate for life amounting to $75,000 with

remainder over to a son - using the age of the widow as 49 years. In column No. 3 opposite 49 in column No. 1 you will find the

figures 11.90076, which is the present value of $1.00 at 5% paid annually to a person 49 years of age. The Inheritance tax law

designates 5% as the income rate. First multiply $75,000 by 5%, which is $3,750.00 the income for each year, then multiply

$3,750.00 by 11.90076, which is $44,627.85, the value of the life interest to the widow. To find the remainder interest subtract

$44,627.85 life interest from $75,000.00.

A will gives to a wife an estate of $40,000 in trust for ten years, she receiving the income during this period with the

remainder to a son in fee. In column No. 4 opposite 10 in column No. 1 you will find the figures 7.721733, which is the present

value of $1.00 at 5% annually for a term of 10 years. The Inheritance Tax law designates 5% as the income rate. First multiply

$40,000 by 5%, which is $2,000.00, the income for each year, then multiply $2,000.00 by 7.721733, which is $15,443.46, the

value of this estate in trust for 10 years.

To find his remainder interest subtract $15,443.46 from $40,000.00.

pg. 14

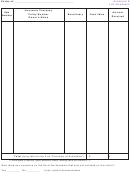

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35