Sales Tax Return - Town Of Larkspur

ADVERTISEMENT

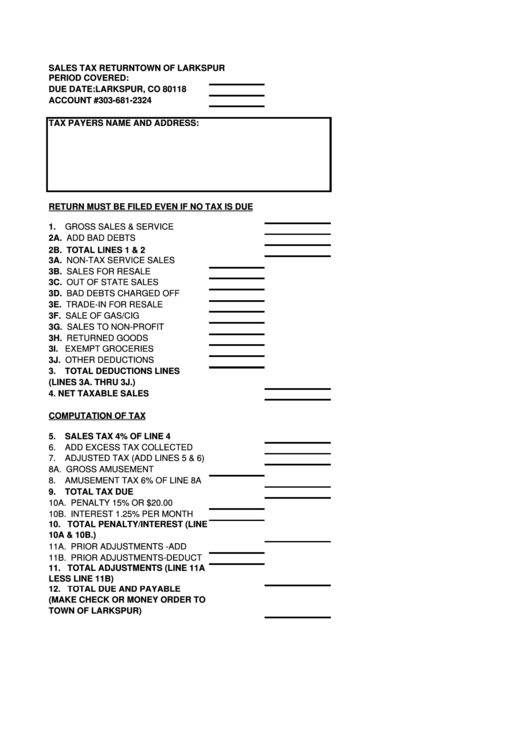

SALES TAX RETURN

TOWN OF LARKSPUR

PERIOD COVERED:

P.O. BOX 310

DUE DATE:

LARKSPUR, CO 80118

ACCOUNT #

303-681-2324

TAX PAYERS NAME AND ADDRESS:

RETURN MUST BE FILED EVEN IF NO TAX IS DUE

1.

GROSS SALES & SERVICE

2A. ADD BAD DEBTS

2B. TOTAL LINES 1 & 2

3A. NON-TAX SERVICE SALES

3B. SALES FOR RESALE

3C. OUT OF STATE SALES

3D. BAD DEBTS CHARGED OFF

3E. TRADE-IN FOR RESALE

3F. SALE OF GAS/CIG

3G. SALES TO NON-PROFIT

3H. RETURNED GOODS

3I. EXEMPT GROCERIES

3J. OTHER DEDUCTIONS

3.

TOTAL DEDUCTIONS LINES

(LINES 3A. THRU 3J.)

4. NET TAXABLE SALES

COMPUTATION OF TAX

5.

SALES TAX 4% OF LINE 4

6.

ADD EXCESS TAX COLLECTED

7.

ADJUSTED TAX (ADD LINES 5 & 6)

8A. GROSS AMUSEMENT

8.

AMUSEMENT TAX 6% OF LINE 8A

9.

TOTAL TAX DUE

10A. PENALTY 15% OR $20.00

10B. INTEREST 1.25% PER MONTH

10. TOTAL PENALTY/INTEREST (LINE

10A & 10B.)

11A. PRIOR ADJUSTMENTS -ADD

11B. PRIOR ADJUSTMENTS-DEDUCT

11. TOTAL ADJUSTMENTS (LINE 11A

LESS LINE 11B)

12. TOTAL DUE AND PAYABLE

(MAKE CHECK OR MONEY ORDER TO

TOWN OF LARKSPUR)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1