2012 Form 565 - Page 2

Credits for Employers in the Aerospace Sector

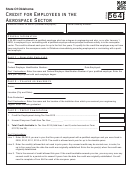

Part 2 – Credit for Compensation Paid to a qualified Employee

The credit for compensation paid to a qualified employee is a percentage of the compensation paid for the first five

years of employment. If the employee graduated from an Oklahoma institution the credit is 10% of such compensation

and if the employee graduated from an institution located outside of Oklahoma the credit is 5%. The credit may not

exceed $12,500 annually for each qualified employee.

Part 2 Credit Computation:

(A) Name of Qualified

(B) Social Security

(C) Date

(D) Name of

(E) Compensation

(F) Credit

Paid

Employee

Number

Hired

Institution

Amount

1.

2.

3.

4.

5.

If more lines are needed, enclose a separate schedule showing the same information as Columns A - F.

Enter the credits from such separate schedule here ...........................................................................................

6.

Total Credit for Compensation Paid - Total Column F, lines 1-5 (Enter here and on Part 3, line 2) ................

Part 2 Instructions:

Columns A & B: Enter the name and Social Security Number of the qualified employee.

Column C: Enter the date employment began.

Column D: Enter the institution from which the qualified employee earned their engineering degree.

Column E: Enter the compensation paid for employment, or wages earned, during the tax year. Employment must be

in the form of contract labor for which Form 1099 was issued and/or wages must be subject to Oklahoma withholding.

Column F: If the employee graduated from an Oklahoma institution, the credit is 10% of the amount in Column E. If the

employee graduated from an institution located outside of Oklahoma, the credit is 5% of the amount in Column E. The

credit for each employee is limited to $12,500 annually. No credit may be claimed after the fifth year of employment.

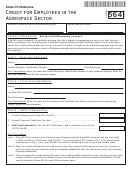

Part 3 – Total Credits Available

1. Credit for Tuition Reimbursed to a Qualified Employee (Enter the amount from Part 1, line 6) ...

2. Credit for Compensation Paid to a Qualified Employee (Enter the amount from Part 2, line 6) .

3. Total - Credits for Employers in the Aerospace Sector -

(Add lines 1 and 2; enter here and on Form 511CR, line 40) ......................................................

1

1 2

2 3

3