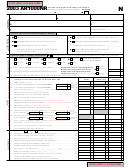

Form Ar1000nr - Arkansas Individual Income Tax Return - 2006 Page 2

ADVERTISEMENT

(A)

Your/Total

(B) Spouse’s Income

Income

Status 4 Only

00

00

ADJUSTED GROSS INCOME: (From Line 27, Columns A and B, Page NR1) ..........28

28.

28

29.

Select tax table: (Check the appropriate box)

LOW INCOME Table 1

REGULAR Table 2

If you qualify for the Low Income Tax Table, enter zero (0) on Line 29A. If not, then:

}

Itemized Deductions (See Instructions, Line 28)

Enter

the larger

OR

00

00

Standard Deduction (See Standard Deduction Instructions) ......29

of your:

29

00

00

NET TAXABLE INCOME: (Subtract Line 29 from Line 28) ..........................................30

30.

30

00

00

TAX: (Enter tax from tax table) ..........................................................................................31

31.

31

00

32.

Combined tax: (Add amounts from Lines 31A and 31B) .................................................................................................32

00

33.

Enter tax from Lump Sum Distribution Averaging Schedule:

(Attach AR1000TD)

.......................................................... 33

00

34.

IRA and qualified plan withdrawal and overpayment penalties:

(Attach Federal Form 5329, if required)

....................... 34

TOTAL TAX: (Add Lines 32 through 34) ......................................................................................................................35

00

35.

00

36.

Personal Tax Credit(s): (Enter total from Line 7D, page NR1) ...........................................36

00

37.

State Political Contributions Credit:

(Attach AR1800 or schedule)

.....................................37

00

38.

Other State Tax Credit:

[Attach copy of other state tax return(s)]

.......................................38

00

(20% of Federal credit allowed; Attach Fed. Form 2441 or Sch. 2)

39.

Child Care Credit:

...............39

00

40.

Credit for Adoption Expenses:

(Attach Form 8839)

............................................................40

00

41.

Phenylketonuria Disorder Credit:

(See Instructions. Attach AR1113)

.................................41

00

42.

Business and Incentive Tax Credit(s):

(Attach schedule and certificate)

............................42

TOTAL CREDITS: (Add Lines 36 through 42) .............................................................................................................43

00

43.

NET TAX: (Subtract Line 43 from Line 35. If Line 43 is greater than Line 35, enter 0) ................................................ 44

00

44.

00

44A. Enter the amount from Line 27, Column C: ............................................................... 44A

00

44B. Enter the total amount from Line 27, Columns A and B: ......................................... 44B

%

44C. Divide Line 44A by 44B: (See Instructions) ...................................................................................................................44C

44D. APPORTIONED TAX LIABILITY: (Multiply Line 44 by Line 44C) .........................................................................44D

00

00

45

Arkansas income tax withheld:

[Attach State copies of W-2 Form(s)]

................................45

00

46.

Estimated tax paid or credit brought forward from last year: ..............................................46

00

47.

Payment made with extension: (See Instructions) .............................................................47

48.

Early childhood program: Certification Number: _________________________________

(20% of Fed. credit; Attach Fed. Form 2441 or 1040A, Sch. 2 and Form AR1000EC)

00

...........48

00

TOTAL PAYMENTS: (Add Lines 45 through 48) .........................................................................................................49

49.

00

AMOUNT OF OVERPAYMENT/REFUND: (If Line 49 is greater than Line 44D, enter difference) ......................... 50

50.

00

51.

Amount to be applied to 2007 estimated tax: .....................................................................51

00

52.

Amount of Check-off Contributions:

(Attach Schedule AR1000-CO)

.................................52

00

AMOUNT TO BE REFUNDED TO YOU: (Subtract Lines 51 and 52 from Line 50) ............................. REFUND 53

53.

00

AMOUNT DUE: (If Line 49 is less than Line 44D, enter difference; If over $1,000, see instructions) ..... TAX DUE 54

54.

00

and enter exception in box

55A. Attach Form AR2210

... 55A

Penalty 55B

55C. Please attach your check or money order, payable to “Dept. of Finance and Administration”, for the tax due

00

and penalty (if applicable). Be sure to write your Social Security Number on your check .................... TOTAL DUE 55C

56.

Amount of income not subject to Arkansas tax from AR4, Part III: (Memorandum only)

May the Arkansas Revenue

Yes

Agency discuss this return with

No

the preparer shown below?

PLEASE SIGN HERE:

Under penalties of perjury, I declare that I have examined this return and accompanying schedules and statements,

and to the best of my knowledge and belief, they are true, correct and complete. Declaration of preparer (other than taxpayer) is based

on all information of which preparer has any knowledge.

Your Signature

Occupation

Date

Home Telephone:

SIGN HERE

Spouse’s Signature

Occupation

Date

Work Telephone:

ID Number/Social Security Number

Paid Preparer’s Signature

For Department Use Only

A

Preparer’s Name

City/State/Zip

B

C

Address

Telephone Number

D

Mail REFUND returns to:

DFA State Income Tax, P. O. Box 1000, Little Rock, AR 72203-1000

E

Mailing Information

Mail TAX DUE returns to:

DFA State Income Tax, P. O. Box 2144, Little Rock, AR 72203-2144

F

Mail NO TAX DUE returns to: DFA State Income Tax, P. O. Box 8026, Little Rock, AR 72203-8026

Please Note: DUE DATE IS APRIL 15, 2007

Page NR2 (R 08/06)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2