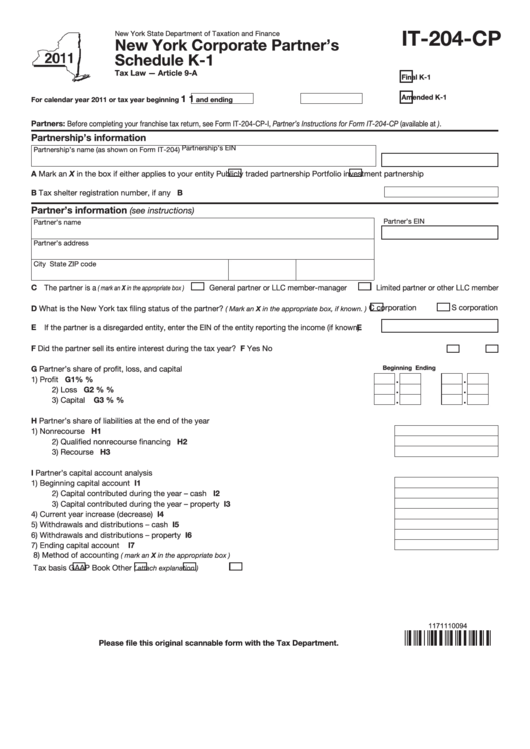

IT-204-CP

New York State Department of Taxation and Finance

New York Corporate Partner’s

Schedule K-1

Tax Law — Article 9-A

Final K-1

1 1

Amended K-1

For calendar year 2011 or tax year beginning

and ending

Partners: Before completing your franchise tax return, see Form IT-204-CP-I, Partner’s Instructions for Form IT-204-CP (available at ).

Partnership’s information

Partnership’s EIN

Partnership’s name (as shown on Form IT-204)

A Mark an X in the box if either applies to your entity

Publicly traded partnership

Portfolio investment partnership

B Tax shelter registration number, if any .......................................................................................... B

Partner’s information

(see instructions)

Partner’s EIN

Partner’s name

Partner’s address

City

State

ZIP code

C The partner is a

General partner or LLC member-manager

Limited partner or other LLC member

( mark an X in the appropriate box )

C corporation

S corporation

D What is the New York tax filing status of the partner?

( Mark an X in the appropriate box, if known. )

E If the partner is a disregarded entity, enter the EIN of the entity reporting the income (if known) ..... E

F

Did the partner sell its entire interest during the tax year? ................................................................................. F Yes

No

G Partner’s share of profit, loss, and capital

Beginning

Ending

1) Profit .............................................................................................................................. G1

%

%

2) Loss ............................................................................................................................... G2

%

%

3) Capital ........................................................................................................................... G3

%

%

H Partner’s share of liabilities at the end of the year

1) Nonrecourse ............................................................................................................................ H1

2) Qualified nonrecourse financing .............................................................................................. H2

3) Recourse ................................................................................................................................. H3

I

Partner’s capital account analysis

1) Beginning capital account ........................................................................................................ I1

2) Capital contributed during the year – cash .............................................................................. I2

3) Capital contributed during the year – property ......................................................................... I3

4) Current year increase (decrease) .............................................................................................. I4

5) Withdrawals and distributions – cash ....................................................................................... I5

6) Withdrawals and distributions – property ................................................................................. I6

7) Ending capital account ............................................................................................................ I7

8) Method of accounting

( mark an X in the appropriate box )

Tax basis

GAAP

Book

Other

( attach explanation )

1171110094

Please file this original scannable form with the Tax Department.

1

1 2

2 3

3 4

4 5

5 6

6