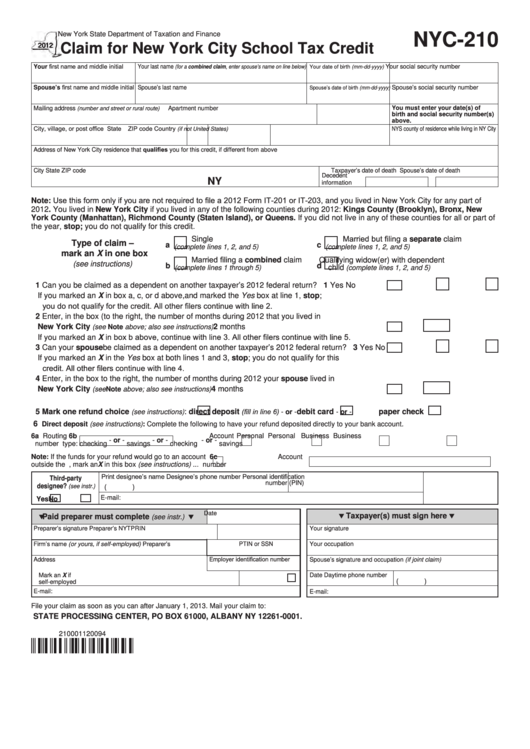

New York State Department of Taxation and Finance

NYC-210

Claim for New York City School Tax Credit

Your first name and middle initial

Your last name

Your social security number

Your date of birth (mm-dd-yyyy)

(for a combined claim, enter spouse’s name on line below)

Spouse’s first name and middle initial Spouse’s last name

Spouse’s social security number

Spouse’s date of birth (mm-dd-yyyy)

Mailing address

Apartment number

You must enter your date(s) of

(number and street or rural route)

birth and social security number(s)

above.

City, village, or post office

State ZIP code

Country

NYS county of residence while living in NY City

(if not United States)

Address of New York City residence that qualifies you for this credit, if different from above

City

State

ZIP code

Taxpayer’s date of death Spouse’s date of death

Decedent

NY

information

Note: Use this form only if you are not required to file a 2012 Form IT-201 or IT-203, and you lived in New York City for any part of

2012. You lived in New York City if you lived in any of the following counties during 2012: Kings County (Brooklyn), Bronx, New

York County (Manhattan), Richmond County (Staten Island), or Queens. If you did not live in any of these counties for all or part of

the year, stop; you do not qualify for this credit.

Single

Married but filing a separate claim

Type of claim –

a

c

(complete lines 1, 2, and 5)

(complete lines 1, 2, and 5)

mark an X in one box

Married filing a combined claim

Qualifying widow(er) with dependent

(see instructions)

child

b

d

(complete lines 1 through 5)

(complete lines 1, 2, and 5)

1 Can you be claimed as a dependent on another taxpayer’s 2012 federal return? .............................

Yes

No

1

If you marked an X in box a, c, or d above, and marked the Yes box at line 1, stop;

you do not qualify for the credit. All other filers continue with line 2.

2 Enter, in the box (to the right, the number of months during 2012 that you lived in

months

(see Note above; also see instructions) ...............................................................................

New York City

2

If you marked an X in box b above, continue with line 3. All other filers continue with line 5.

3 Can your spouse be claimed as a dependent on another taxpayer’s 2012 federal return? ..............

Yes

No

3

If you marked an X in the Yes box at both lines 1 and 3, stop; you do not qualify for this

credit. All other filers continue with line 4.

4 Enter, in the box to the right, the number of months during 2012 your spouse lived in

.......................................................................

months

New York City

4

(see Note above; also see instructions)

:

(fill in line 6)

- or -

- or -

5 Mark one refund choice

direct deposit

debit card

paper check

(see instructions)

Direct deposit (see instructions): Complete the following to have your refund deposited directly to your bank account.

6

Routing

6b Account

Personal

Personal

Business

Business

6a

- or -

- or -

- or -

number

type:

checking

savings

checking

savings

Note: If the funds for your refund would go to an account

Account

6c

outside the U.S., mark an X in this box (see instructions) ...

number

Print designee’s name

Designee’s phone number

Personal identification

Third-party

number (PIN)

(

)

designee?

(see instr.)

E-mail:

Yes

No

Date

Taxpayer(s) must sign here

Paid preparer must complete

(see instr.)

Preparer’s signature

Preparer’s NYTPRIN

Your signature

Firm’s name (or yours, if self-employed)

Preparer’s PTIN or SSN

Your occupation

Address

Employer identification number

Spouse’s signature and occupation (if joint claim)

Mark an X if

Date

Daytime phone number

(

)

self-employed

E-mail:

E-mail:

File your claim as soon as you can after January 1, 2013. Mail your claim to:

STATE PROCESSING CENTER, PO BOX 61000, ALBANY NY 12261-0001.

210001120094

1

1 2

2