Form Ct-4 - General Business Corporation Franchise Tax Return Short Form - 2012

ADVERTISEMENT

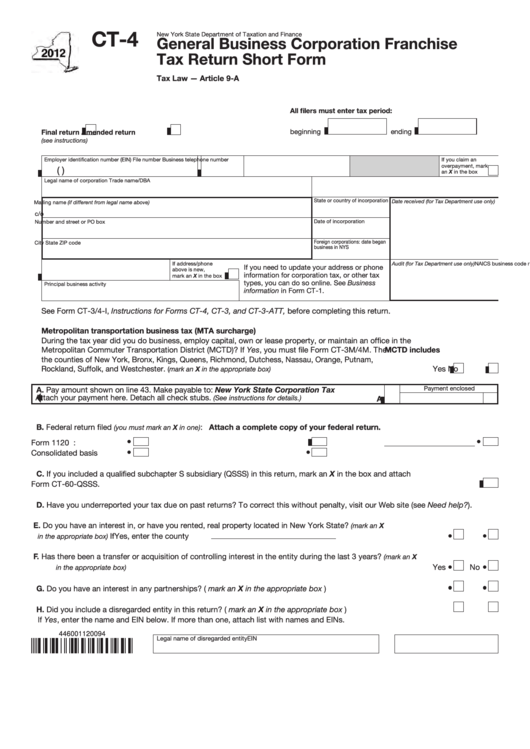

CT-4

New York State Department of Taxation and Finance

General Business Corporation Franchise

Tax Return Short Form

Tax Law — Article 9-A

All filers must enter tax period:

beginning

ending

Final return

Amended return

(see instructions)

Employer identification number (EIN)

File number

Business telephone number

If you claim an

overpayment, mark

(

)

an X in the box

Legal name of corporation

Trade name/DBA

State or country of incorporation

Date received (for Tax Department use only)

Mailing name (if different from legal name above)

c/o

Date of incorporation

Number and street or PO box

Foreign corporations: date began

City

State

ZIP code

business in NYS

NAICS business code number

If address/phone

Audit (for Tax Department use only)

(from federal return)

If you need to update your address or phone

above is new,

information for corporation tax, or other tax

mark an X in the box

types, you can do so online. See Business

Principal business activity

information in Form CT-1.

See Form CT-3/4-I, Instructions for Forms CT-4, CT-3, and CT-3-ATT, before completing this return.

Metropolitan transportation business tax (MTA surcharge)

During the tax year did you do business, employ capital, own or lease property, or maintain an office in the

Metropolitan Commuter Transportation District (MCTD)? If Yes, you must file Form CT-3M/4M. The MCTD includes

the counties of New York, Bronx, Kings, Queens, Richmond, Dutchess, Nassau, Orange, Putnam,

Rockland, Suffolk, and Westchester.

........................................................................... Yes

No

(mark an X in the appropriate box)

A. Pay amount shown on line 43. Make payable to: New York State Corporation Tax

Payment enclosed

Attach your payment here. Detach all check stubs.

(See instructions for details.)

A

B. Federal return filed

:

Attach a complete copy of your federal return.

(you must mark an X in one)

Form 1120 ..................

Form 1120-H ..................................

Other:

Consolidated basis ....

Form 1120S ...................................

C. If you included a qualified subchapter S subsidiary (QSSS) in this return, mark an X in the box and attach

Form CT-60-QSSS. ..................................................................................................................................................................

D. Have you underreported your tax due on past returns? To correct this without penalty, visit our Web site (see Need help?).

E. Do you have an interest in, or have you rented, real property located in New York State?

(mark an X

If Yes, enter the county

......................................... Yes

No

in the appropriate box)

F. Has there been a transfer or acquisition of controlling interest in the entity during the last 3 years?

(mark an X

........................................................................................................................................... Yes

No

in the appropriate box)

G. Do you have an interest in any partnerships? ( mark an X in the appropriate box ) .............................................. Yes

No

H. Did you include a disregarded entity in this return? ( mark an X in the appropriate box ) ..................................... Yes

No

If Yes, enter the name and EIN below. If more than one, attach list with names and EINs.

446001120094

Legal name of disregarded entity

EIN

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4