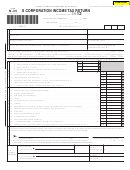

Form Ct-3-S - New York S Corporation Franchise Tax Return - 2012 Page 2

ADVERTISEMENT

Page 2 of 3 CT-3-S (2012)

Provide the information for lines 1 through 10 from the corresponding lines on your federal Form 1120S, Schedule K, total

amount column.

(Show any negative amounts with a minus (-) sign; do not use parentheses or brackets.)

1 Ordinary business income or loss ...................................................................................................

1

2 Net rental real estate income or loss ..............................................................................................

2

3 Other net rental income or loss .......................................................................................................

3

4 Interest income ...............................................................................................................................

4

5 Ordinary dividends ..........................................................................................................................

5

6 Royalties .........................................................................................................................................

6

7 Net short-term capital gain or loss ..................................................................................................

7

8 Net long-term capital gain or loss ...................................................................................................

8

9 Net section 1231 gain or loss..........................................................................................................

9

10 Other income or loss .......................................................................................................................

10

11 Loans to shareholders

(from federal Form 1120S, Schedule L, line 7, columns b and d)

Beginning of tax year

End of tax year

12 Total assets

(from federal Form 1120S, Schedule L, line 15, columns b and d)

Beginning of tax year

End of tax year

13 Loans from shareholders

)

(from federal Form 1120S, Schedule L, line 19, columns b and d

Beginning of tax year

End of tax year

Provide the information for lines 14 through 21 from the corresponding lines on your federal Form 1120S, Schedule M-2.

(Show any negative amounts with a minus (-) sign; do not use parentheses or brackets.)

A

B

C

Accumulated adjustments

Other adjustments

Shareholders’ undistributed

account

account

taxable income previously

taxed

14 Balance at beginning of tax year.................

15 Ordinary income from federal Form 1120S,

page 1, line 21 .........................................

16 Other additions............................................

17 Loss from federal Form 1120S, page 1,

line 21 ......................................................

18 Other reductions .........................................

19 Add lines 14 through 18 ..............................

20 Distributions other than dividend distributions .

21 Balance at end of tax year. Subtract line 20

from line 19..............................................

Computation of tax

(see instructions)

You must enter an amount on line 22; if none, enter 0.

22 New York receipts ...........................................................................................................................

22

23 Fixed dollar minimum tax ...............................................................................................................

23

24 Recapture of tax credits .................................................................................................................

24

25 Total tax after recapture of tax credits

.............................................................

25

(add lines 23 and 24)

................................................

26 Special additional mortgage recording tax credit

26

(from Form CT-43)

27 Tax due after tax credits

......................................................................

27

(subtract line 26 from line 25)

First installment of estimated tax for the next tax period:

28 Enter amount from line 27................................................................................................................. 28

29 If you filed a request for extension, enter amount from Form CT-5.4, line 2 ...................................

29

30 If you did not file Form CT-5.4 and line 28 is over $1,000, enter 25% (.25) of line 28.

Otherwise enter 0 .......................................................................................................................

30

31 Add line 28 and line 29 or 30 ............................................................................................................ 31

440002120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3