How do I amend for a net operating loss (NOL)?

Example 3: You received a federal tax refund in 2011 for

amending your 2008 income tax return. You may need to

Generally, if you carry an NOL back for federal purposes,

report the refund as an addition on your 2011 return. If you

you also must carry the Oregon NOL back for Oregon pur-

already filed your 2011 return, you may need to amend it.

poses. There is an exception if you were not required to file

an Oregon return for all years to which the federal NOL

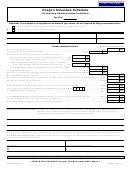

Federal refund worksheet

deduction is applied. If you elect to carry forward the federal

Use this worksheet to determine the tax benefit received

NOL, then you must also carry forward the Oregon NOL.

and the amount to include in Oregon income in the year

you received the refund.

An Oregon NOL is defined the same as a federal NOL.

However, you may have an Oregon NOL without having

1. Enter the federal tax liability on your

1.

a federal NOL. Your Oregon NOL is computed under the

original federal return.

federal methods. The only modification is for amounts

2. Enter the federal tax subtraction limit for

2.

that Oregon is prohibited from taxing, such as interest

the year you are amending.

from U.S. Series EE, HH, or I bonds (U.S. government

3. Line 1 minus line 2. (Enter -0- if line 2 is

3.

interest).

greater than line 1.)

Generally, an NOL for a full-year resident is the same as the

4. Enter the refund of the prior year’s federal

4.

federal NOL. Nonresidents are allowed an Oregon NOL if

tax.

it is generated from Oregon sources.

5. If line 3 is greater than line 4, no

5.

adjustment is needed on your Oregon

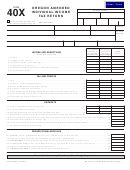

If you are amending for an NOL, be sure to check the

amended return. If line 4 is greater than

“amending due to an NOL” box on the amended schedule

line 3, enter line 4 minus line 3 here and

and show the year of the NOL and the NOL calculations.

on your Form 40 as an addition and

identify with code 109; or on your Form

Do I change my federal tax liability on my

40N or Form 40P as an other deduction or

amended return?

modification and identify with code 601.

Usually not, but follow these special instructions for federal

tax liability:

Line instructions for the amended schedule

• Did we correct the federal tax subtraction on your original

Instructions are for lines not fully explained on the form.

return? If so, use the corrected amount from our notice.

Write the tax year that you are amending on the Oregon

• Did you amend your federal return before the due date

Amended Schedule.

(not including extensions) of the original return? If so, the

federal tax on your amended federal return is the amount

Do not fill in cents. You must round off cents to the near-

you will use for your amended Oregon return. There will

est dollar. For example, $24.49 becomes $24.00 and $24.50

be no addition or subtraction in a later year.

becomes $25.00.

• Did you pay additional federal tax because you were

audited or filed an amended return after the due date of

Tax

the original return? If so, claim the additional federal tax

as a subtraction on your Oregon return in the year you

101. Net income tax as amended. This is your amended

paid the additional tax.

tax after nonrefundable credits from your amended return

• Did you get a refund of federal tax because you were

(do not include refundable tax credits, see line 103). If your

audited or filed an amended return after the due date

credits are more than your tax, enter -0-.

of the original return? If so, show the federal tax refund

as an addition on your Oregon return in the year you

Payments and refundable credits

received the refund, but only if you received a tax benefit.

102. Oregon income tax withheld as amended. If you are

See the federal refund worksheet below.

correcting the amount of state tax withheld, you must

Example 1: You received a notice from the Oregon Depart-

attach a copy of any additional or corrected Form W-2 or

ment of Revenue in May and are filling out an amended

1099. If this hasn’t changed, enter the amount from your

return in July. The notice stated that your federal tax sub-

previous return.

traction was reduced from $3,500 to $3,000. You will use

103. Refundable tax credits as amended. Enter the appropri-

the corrected federal tax subtraction of $3,000, on your

ate amounts as directed below from your amended return

amended return.

on lines 103a, 103b, and 103c.

Example 2: You paid additional federal tax in 2011 for an

103a. Earned income credit (EIC) as amended. Tax years

audit adjustment on your 2008 federal tax return. Amend

2005 and earlier, enter -0- and go to line 103b. Tax years

your 2008 Oregon tax return for the audit adjustments, but

2006 and later, enter your corrected Oregon earned income

do not change the 2008 federal tax subtraction. You can

credit from your amended return. If your federal EIC hasn’t

subtract the additional 2008 federal tax liability you paid in

changed, your Oregon EIC will be the same as on your pre-

2011 on your 2011 return up to the limit. See instructions in

the 2011 income tax booklet for limits.

vious return.

2

150-101-061 (Rev. 12-11)

1

1 2

2 3

3 4

4 5

5 6

6