Instructions For Form 3307 - Loss Adjustment Worksheet For The Small Business Credit

ADVERTISEMENT

Instructions for Form 3307,

Loss Adjustment Worksheet for the Small Business Credit

not equal or exceed the loss adjustment required on

Purpose: To adjust the adjusted business income to

line 9, the taxpayer may still calculate a lesser loss

qualify for the small business credit or minimize the

adjustment to claim a reduced credit.

reduction percentage required.

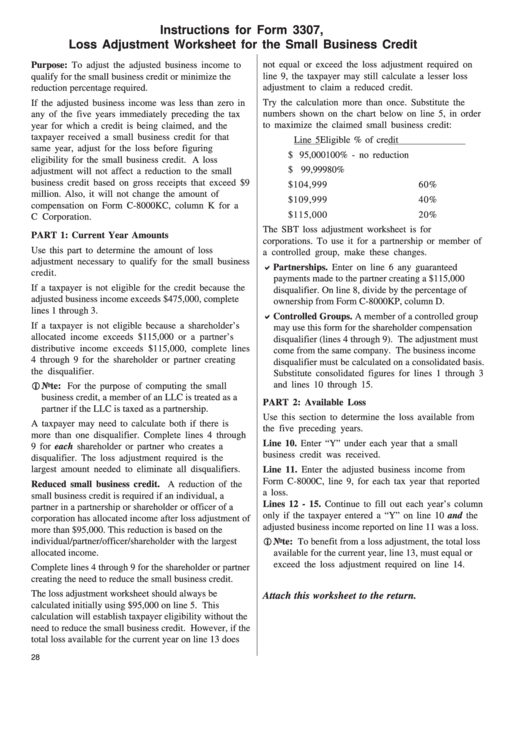

Try the calculation more than once. Substitute the

If the adjusted business income was less than zero in

numbers shown on the chart below on line 5, in order

any of the five years immediately preceding the tax

to maximize the claimed small business credit:

year for which a credit is being claimed, and the

taxpayer received a small business credit for that

Line 5

Eligible % of credit

same year, adjust for the loss before figuring

$ 95,000

100% - no reduction

eligibility for the small business credit. A loss

$ 99,999

80%

adjustment will not affect a reduction to the small

business credit based on gross receipts that exceed $9

$104,999

60%

million. Also, it will not change the amount of

$109,999

40%

compensation on Form C-8000KC, column K for a

$115,000

20%

C Corporation.

The SBT loss adjustment worksheet is for

PART 1: Current Year Amounts

corporations. To use it for a partnership or member of

Use this part to determine the amount of loss

a controlled group, make these changes.

adjustment necessary to qualify for the small business

Partnerships. Enter on line 6 any guaranteed

credit.

payments made to the partner creating a $115,000

If a taxpayer is not eligible for the credit because the

disqualifier. On line 8, divide by the percentage of

adjusted business income exceeds $475,000, complete

ownership from Form C-8000KP, column D.

lines 1 through 3.

Controlled Groups. A member of a controlled group

If a taxpayer is not eligible because a shareholder ’ s

may use this form for the shareholder compensation

allocated income exceeds $115,000 or a partner ’ s

disqualifier (lines 4 through 9). The adjustment must

distributive income exceeds $115,000, complete lines

come from the same company. The business income

4 through 9 for the shareholder or partner creating

disqualifier must be calculated on a consolidated basis.

the disqualifier.

Substitute consolidated figures for lines 1 through 3

and lines 10 through 15.

Note: For the purpose of computing the small

business credit, a member of an LLC is treated as a

PART 2: Available Loss

partner if the LLC is taxed as a partnership.

Use this section to determine the loss available from

A taxpayer may need to calculate both if there is

the five preceding years.

more than one disqualifier. Complete lines 4 through

Line 10. Enter “Y” under each year that a small

9 for each shareholder or partner who creates a

business credit was received.

disqualifier. The loss adjustment required is the

largest amount needed to eliminate all disqualifiers.

Line 11. Enter the adjusted business income from

Form C-8000C, line 9, for each tax year that reported

Reduced small business credit. A reduction of the

a loss.

small business credit is required if an individual, a

Lines 12 - 15. Continue to fill out each year ’ s column

partner in a partnership or shareholder or officer of a

only if the taxpayer entered a “Y” on line 10 and the

corporation has allocated income after loss adjustment of

adjusted business income reported on line 11 was a loss.

more than $95,000. This reduction is based on the

individual/partner/officer/shareholder with the largest

Note: To benefit from a loss adjustment, the total loss

allocated income.

available for the current year, line 13, must equal or

exceed the loss adjustment required on line 14.

Complete lines 4 through 9 for the shareholder or partner

creating the need to reduce the small business credit.

The loss adjustment worksheet should always be

Attach this worksheet to the return.

calculated initially using $95,000 on line 5. This

calculation will establish taxpayer eligibility without the

need to reduce the small business credit. However, if the

total loss available for the current year on line 13 does

28

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1