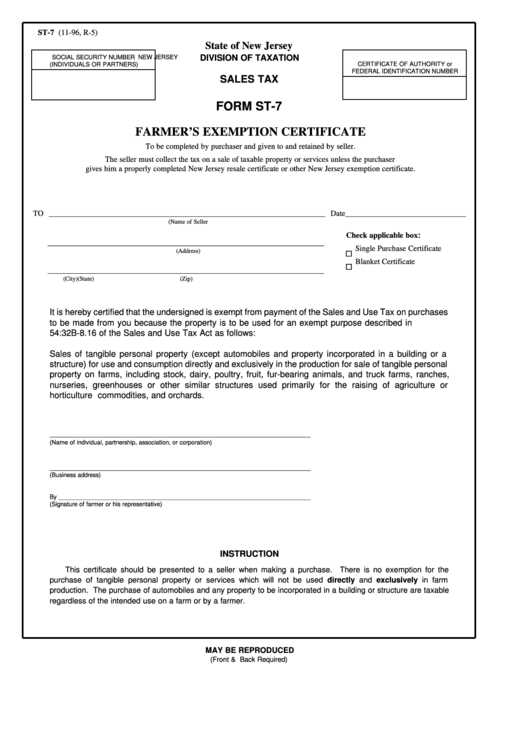

ST-7 (11-96, R-5)

State of New Jersey

DIVISION OF TAXATION

SOCIAL SECURITY NUMBER

NEW JERSEY

CERTIFICATE OF AUTHORITY or

(INDIVIDUALS OR PARTNERS)

FEDERAL IDENTIFICATION NUMBER

SALES TAX

FORM ST-7

FARMER’S EXEMPTION CERTIFICATE

To be completed by purchaser and given to and retained by seller.

The seller must collect the tax on a sale of taxable property or services unless the purchaser

gives him a properly completed New Jersey resale certificate or other New Jersey exemption certificate.

TO _______________________________________________________________________ Date _______________________________

(Name of Seller

Check applicable box:

_______________________________________________________________________

Single Purchase Certificate

(Address)

Blanket Certificate

_______________________________________________________________________

(City)

(State)

(Zip)

It is hereby certified that the undersigned is exempt from payment of the Sales and Use Tax on purchases

to be made from you because the property is to be used for an exempt purpose described in N.J.S.A.

54:32B-8.16 of the Sales and Use Tax Act as follows:

Sales of tangible personal property (except automobiles and property incorporated in a building or a

structure) for use and consumption directly and exclusively in the production for sale of tangible personal

property on farms, including stock, dairy, poultry, fruit, fur-bearing animals, and truck farms, ranches,

nurseries, greenhouses or other similar structures used primarily for the raising of agriculture or

horticulture commodities, and orchards.

___________________________________________________________________

(Name of individual, partnership, association, or corporation)

___________________________________________________________________

(Business address)

By __________________________________________________________________________

(Signature of farmer or his representative)

INSTRUCTION

This certificate should be presented to a seller when making a purchase. There is no exemption for the

purchase of tangible personal property or services which will not be used directly and exclusively in farm

production. The purchase of automobiles and any property to be incorporated in a building or structure are taxable

regardless of the intended use on a farm or by a farmer.

MAY BE REPRODUCED

(Front & Back Required)

1

1