Form Rpd-41058 - Estate Tax Return Page 2

ADVERTISEMENT

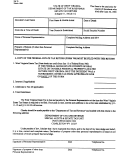

RPD-41058

STATE OF NEW MEXICO - TAXATION AND REVENUE DEPARTMENT

Rev. 01/2008

ESTATE TAX RETURN INSTRUCTIONS

WHO MUST FILE THIS FORM:

The personal representative of every estate subject to the tax imposed by the Estate Tax Act {7-7-1 to 7-7-12 NMSA 1978} who is required by the laws

of the United States to file a federal estate tax return shall file a return for the taxes due under the Estate Tax Act and a copy of the federal estate tax

return with the Department on or before the date the federal estate tax return is required to be filed. The due date is nine months following the date of

death plus any extension of time for filing the federal estate tax return. The estate tax is an amount equal to the federal credit for state death tax imposed

on the transfer of the net estate of every resident, and the net estate located in New Mexico of every nonresident.

HOW TO COMPLETE THE FORM:

Complete the information requested for the decedent, the personal representative, the attorney if applicable, and the names of the county(ies) in which

the estate or any part of the estate is located.

•

Circle yes or no to indicate the residency status of the decedent. A decedent is a resident when domiciled in New Mexico at the time of death.

•

Enter the name and address of the personal representative or if more than one, enter the primary contact on the form and attach a list of the name,

address, and phone number of each personal representative. Personal representative means the executor or administrator of a decedent, or, if no

executor or administrator is appointed, qualified and acting, any person who has possession of any property.

•

Enter the name of the New Mexico county(ies), or the name and address of any county(ies) located outside of New Mexico in which the estate or

any part of the estate is located. If more than one county, attach a list. NOTE: If you wish a certificate to be sent to a county outside New Mexico,

you must provide a mailing address for the out-of-state county clerk’s office. The Department shall file a certificate indicating no tax due or that all

tax is paid with the clerk of the county(ies) as specified by the personal representative or other person who has filed the return.

Line 1 and 2. Complete the information as requested from federal form 706, United States Estate (and Generation-skipping Transfer) Tax Return.

Lines 3a through 3e. Complete if the decedent was a resident of New Mexico on the date of death. Credit may be allowed for estate tax paid to

another state and credited against the federal estate tax. If no tax was paid to another state, enter the amount from line 2 on line 3e and go to line 5.

When the total gross estate is located within New Mexico, the entire portion of the federal state death tax credit is due.

A credit for tax paid to another state is allowed when any property of a resident is subject to a death tax imposed by another state for which a

federal credit for state death tax is allowed. To qualify, the tax imposed by the other state must not be qualified by a reciprocal provision allowing

the property to be taxed in the state of the decedent’s domicile. The amount of the credit for tax paid to the other state is equal to the lesser of:

1. the amount of the death tax paid the other state and credited against the federal estate tax, or

2. an amount computed by multiplying the federal credit by a fraction, the numerator of which is the value of the property

subject to the death tax imposed by the other state and the denominator of which is the value of the decedent’s gross estate.

Lines 4a and 4b. Complete if the decedent was a nonresident of New Mexico. A nonresident of New Mexico shall compute the tax by multiplying

the federal credit by a fraction, the numerator of which is the value of the property located in New Mexico and the denominator of which is the value of

the decedent’s gross estate. Property located in New Mexico includes debts arising from transactions in, or having a business situs in New Mexico and

from the securities of any corporation or other entity organized under the laws of New Mexico. The transfer of the personal property of a nonresident

decedent is exempt from the tax imposed by this Act to the extent that the personal property of residents is exempt from taxation under the laws of

the state in which the nonresident is domiciled. Real property in this state belonging to a nonresident decedent includes royalty interests in oil, gas or

similar leases or property interests. For purposes of the Estate Tax Act, mortgages are considered personal property and cannot be netted against the

value of real property located in New Mexico.

Line 5. All taxpayers must complete this line. Enter line 3e if the decedent is a resident or line 4b if the decedent is a nonresident.

Line 7. Enter any art acceptance credit allowed. Works of art may be accepted in lieu of payment of estate tax under certain circumstances. A de-

cedent’s estate may pay all or a part of any tax owed by the decedent’s estate to the state by payment in the form of one or more works of art in the

manner provided by the Art Acceptance Act {7-7-15 to 7-7-20 NMSA 1978}, provided the decedent has so directed by a will, or the personal representa-

tive finds that this method of payment is advantageous to the estate. To claim the credit, attach the following to the New Mexico estate tax return: a) a

copy of the appraisal of the work, b) the Board of Regents of the Museum of New Mexico’s judgement to accept the works of art as payment or partial

payment for the estate tax, and (c) the Taxation and Revenue Department’s notice of agreement to accept the works of art as payment. The value of

the art cannot exceed the amount of the estate tax owed by the decedent’s estate.

Penalty will be assessed if the entity fails to file timely or to pay when due the amount on line 9. The Department will calculate penalty by multiplying

the amount on line 9 by 2%, then by the number of months or partial months for which the return or payment is late, not to exceed 20% of the tax due.

The penalty may not be less than $5.00.

Interest will be assessed if the amount on line 9 was not paid by the due date. Interest is computed on a daily basis, at the rate established by the

U.S. Internal Revenue Code (IRC), of the unpaid amount for each day the payment is late. The formula for calculating daily interest is: tax due x the

daily interest rate for the quarter x number of days late = interest due.

NOTE: If any adjustment is made in the basis for computation of any federal tax, the estate must file with New Mexico an amended return within 30

days. Attach a copy of the amended federal return and all attachments.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2