Form Rpd-41353 - Owner'S Or Remittee'S Agreement To Pay Withholding On Behalf Of A Pass-Through Entity Or Remitter - State Of New Mexico Taxation And Revenue Department

ADVERTISEMENT

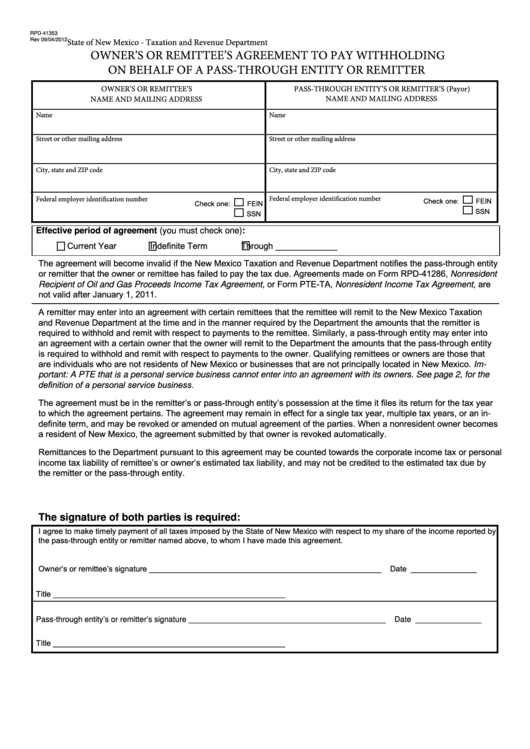

RPD-41353

State of New Mexico - Taxation and Revenue Department

Rev 09/04/2012

OWNER’S OR REMITTEE’S AGREEMENT TO PAY WITHHOLDING

ON BEHALF OF A PASS-THROUGH ENTITY OR REMITTER

PASS-THROUGH ENTITY’S OR REMITTER’S (Payor)

OWNER’S OR REMITTEE’S

NAME AND MAILING ADDRESS

NAME AND MAILING ADDRESS

Name

Name

Street or other mailing address

Street or other mailing address

City, state and ZIP code

City, state and ZIP code

Federal employer identification number

Federal employer identification number

Check one:

FEIN

Check one:

FEIN

SSN

SSN

Effective period of agreement (you must check one):

Current Year

Indefinite Term

Through _____________

The agreement will become invalid if the New Mexico Taxation and Revenue Department notifies the pass-through entity

or remitter that the owner or remittee has failed to pay the tax due. Agreements made on Form RPD-41286, Nonresident

Recipient of Oil and Gas Proceeds Income Tax Agreement, or Form PTE-TA, Nonresident Income Tax Agreement, are

not valid after January 1, 2011.

A remitter may enter into an agreement with certain remittees that the remittee will remit to the New Mexico Taxation

and Revenue Department at the time and in the manner required by the Department the amounts that the remitter is

required to withhold and remit with respect to payments to the remittee. Similarly, a pass-through entity may enter into

an agreement with a certain owner that the owner will remit to the Department the amounts that the pass-through entity

is required to withhold and remit with respect to payments to the owner. Qualifying remittees or owners are those that

are individuals who are not residents of New Mexico or businesses that are not principally located in New Mexico. Im-

portant: A PTE that is a personal service business cannot enter into an agreement with its owners. See page 2, for the

definition of a personal service business.

The agreement must be in the remitter’s or pass-through entity’s possession at the time it files its return for the tax year

to which the agreement pertains. The agreement may remain in effect for a single tax year, multiple tax years, or an in-

definite term, and may be revoked or amended on mutual agreement of the parties. When a nonresident owner becomes

a resident of New Mexico, the agreement submitted by that owner is revoked automatically.

Remittances to the Department pursuant to this agreement may be counted towards the corporate income tax or personal

income tax liability of remittee’s or owner’s estimated tax liability, and may not be credited to the estimated tax due by

the remitter or the pass-through entity.

The signature of both parties is required:

I agree to make timely payment of all taxes imposed by the State of New Mexico with respect to my share of the income reported by

the pass-through entity or remitter named above, to whom I have made this agreement.

Owner’s or remittee’s signature _____________________________________________________ Date _______________

Title _____________________________________________________

Pass-through entity’s or remitter’s signature _____________________________________________

Date _______________

Title _____________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2