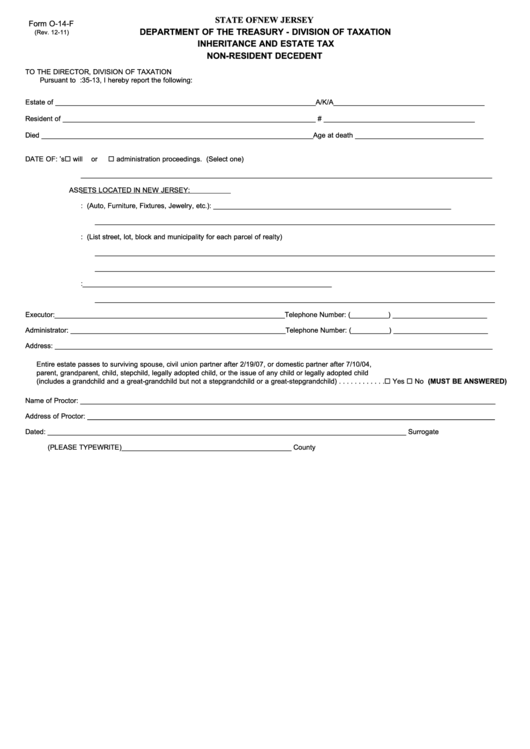

STATE OF NEW JERSEY

Form O-14-F

DEPARTMENT OF THE TREASURY - DIVISION OF TAXATION

(Rev. 12-11)

INHERITANCE AND ESTATE TAX

NON-RESIDENT DECEDENT

TO THE DIRECTOR, DIVISION OF TAXATION

Pursuant to R.S. 54:35-13, I hereby report the following:

Estate of _____________________________________________________________________

A/K/A ________________________________________

Resident of ___________________________________________________________________

S.S.# ________________________________________

Died ________________________________________________________________________

Age at death __________________________________

DATE OF:

1. Filing of exemplified copy of nonresident’s

will

or

administration proceedings. (Select one)

_____________________________________________________________________________________________________________

2. TYPE OF ASSETS LOCATED IN NEW JERSEY:

A.

TANGIBLE: (Auto, Furniture, Fixtures, Jewelry, etc.): _______________________________________________________________

__________________________________________________________________________________________________________

B.

REAL: (List street, lot, block and municipality for each parcel of realty)

__________________________________________________________________________________________________________

__________________________________________________________________________________________________________

C. If no assets listed in A or B state reason for filing:__________________________________________________________________

__________________________________________________________________________________________________________

Executor:_____________________________________________________________

Telephone Number: (__________) _________________________

Administrator: _________________________________________________________

Telephone Number: (__________) _________________________

Address: ____________________________________________________________________________________________________________________

Entire estate passes to surviving spouse, civil union partner after 2/19/07, or domestic partner after 7/10/04,

parent, grandparent, child, stepchild, legally adopted child, or the issue of any child or legally adopted child

(includes a grandchild and a great-grandchild but not a stepgrandchild or a great-stepgrandchild) . . . . . . . . . . . .

Yes

No (MUST BE ANSWERED)

Name of Proctor: ______________________________________________________________________________________________________________

Address of Proctor: ____________________________________________________________________________________________________________

Dated: __________________________________________________

_____________________________________________ Surrogate

(PLEASE TYPEWRITE)

_____________________________________________ County

1

1