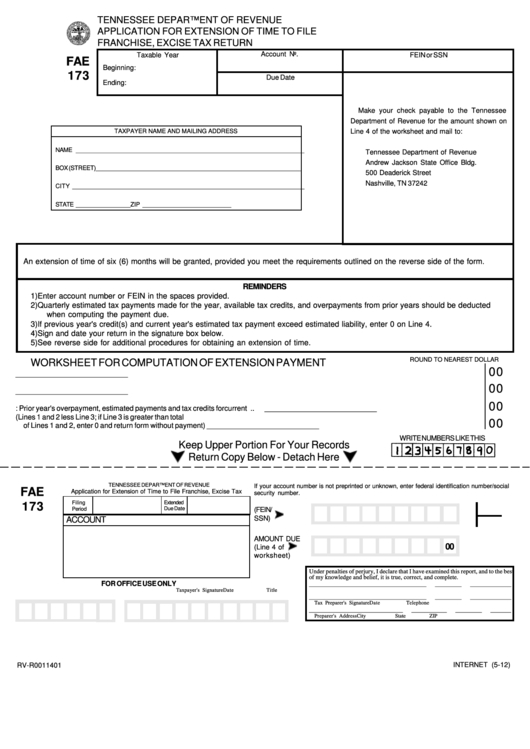

TENNESSEE DEPARTMENT OF REVENUE

APPLICATION FOR EXTENSION OF TIME TO FILE

FRANCHISE, EXCISE TAX RETURN

Account No.

Taxable Year

FEIN or SSN

FAE

Beginning:

173

Due Date

Ending:

Make your check payable to the Tennessee

Department of Revenue for the amount shown on

TAXPAYER NAME AND MAILING ADDRESS

Line 4 of the worksheet and mail to:

NAME ___________________________________________________________________

Tennessee Department of Revenue

Andrew Jackson State Office Bldg.

BOX (STREET) ____________________________________________________________

500 Deaderick Street

Nashville, TN 37242

CITY ____________________________________________________________________

STATE ________________

ZIP __________________________

An extension of time of six (6) months will be granted, provided you meet the requirements outlined on the reverse side of the form.

REMINDERS

1)

Enter account number or FEIN in the spaces provided.

2)

Quarterly estimated tax payments made for the year, available tax credits, and overpayments from prior years should be deducted

when computing the payment due.

3)

If previous year's credit(s) and current year's estimated tax payment exceed estimated liability, enter 0 on Line 4.

4)

Sign and date your return in the signature box below.

5)

See reverse side for additional procedures for obtaining an extension of time.

ROUND TO NEAREST DOLLAR

WORKSHEET FOR COMPUTATION OF EXTENSION PAYMENT

00

1. Estimated Franchise Tax current year .....................................................................................................................

___________________________

00

2. Estimated Excise Tax current year ............................................................................................................................

___________________________

00

3. Deduct: Prior year's overpayment, estimated payments and tax credits for current year ..........................................

___________________________

4. Amount due with extension request (Lines 1 and 2 less Line 3; if Line 3 is greater than total

00

of Lines 1 and 2, enter 0 and return form without payment) ......................................................................................

___________________________

WRITE NUMBERS LIKE THIS

Keep Upper Portion For Your Records

Return Copy Below - Detach Here

TENNESSEE DEPARTMENT OF REVENUE

If your account number is not preprinted or unknown, enter federal identification number/social

FAE

Application for Extension of Time to File Franchise, Excise Tax

security number.

Extended

Filing

173

Due Date

Period

(FEIN/

SSN)

ACCOUNT

AMOUNT DUE

00

(Line 4 of

worksheet)

Under penalties of perjury, I declare that I have examined this report, and to the best

of my knowledge and belief, it is true, correct, and complete.

FOR OFFICE USE ONLY

________________________________________

_________

______________

Taxpayer's Signature

Date

Title

________________________________________

_________

______________

Tax Preparer's Signature

Date

Telephone

________________________________

____________

_________

_______

Preparer's Address

City

State

ZIP

INTERNET (5-12)

RV-R0011401

1

1 2

2