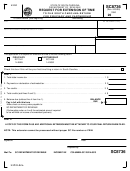

Form Sc8736 - Request For Extension Of Time To File South Carolina Return For Fiduciary And Partnership Page 2

ADVERTISEMENT

SC8736 INSTRUCTIONS

NOTE: For returns due on or after January 1, 2009, South Carolina conforms to the IRS change reducing the extended time

allowed for filing fiduciary and partnership returns to five months from the original due date.

A.

WHO MAY FILE: This application can be used by the following:

1. a partnership filing an SC1065

2. a fiduciary filing an SC1041

Mark the appropriate box on the front of this form to indicate the type of extension being requested.

If you estimate that your SC income tax return will show a tax balance due, you are required to file a SC extension form and pay

all taxes due by the due date of the return (generally April 15). To avoid the failure to pay penalty, you must pay at least 90% of

the tax due by this date.

The extension must be properly signed.

NOTE: In order to obtain an extension of time to file a composite SC1040 return, one SC4868 must be submitted in the name

and Federal Employer Identification Number of the entity.

This form extends the time allowed for filing a return for up to five months from the original due date. Requests for additional

extensions of time generally are not granted.

REMINDERS:

See SC1065 and instructions for information on the requirement by partnerships to pay withholding tax on South

Carolina taxable income of nonresident partners.

Refunds cannot be issued from the SC1065. An overpayment must be claimed and refunded at the partner level.

B.

WHEN TO FILE: File this application ON OR BEFORE April 15th, or before the original due date of your fiscal year

return. If the due date for filing your return falls on a Saturday, Sunday, or legal holiday, substitute the next regular working day.

C.

HOW AND WHERE TO FILE: File the original SC8736 with the SC Department of Revenue and pay the amount on line

5, Part I. Attach a copy to the back of your return when it is filed. Retain a copy of this form for your records. Your tax return may

be filed any time prior to the expiration of the extension.

D.

HOW TO CLAIM CREDIT FOR PAYMENT MADE WITH THIS APPLICATION ON YOUR RETURN: Show the amount

paid with this application on the appropriate line of your tax return. Correct identification numbers in the spaces provided

on all forms are very important!

E.

COMPUTE AMOUNT DUE WITH EXTENSION:

LINE 1.

Enter the amount of income tax you expect to owe for the current tax year (the amount you expect to enter on the tax

return, when you file). Be sure to use good judgement in estimating the amount you owe. To avoid the failure to pay penalty,

you must pay at least 90% of the tax due by April 15, and pay the balance due when you file your return within the extended

time period.

LINE 5. An extension of time to file your tax return will NOT extend the time to PAY your income tax. Therefore, you must

PAY IN FULL WITH THIS FORM the amount of income tax shown on line 5, Part I, page 1. Make your check payable to the

"SC Department of Revenue". Write your file number and/or FEIN and enter the tax year followed by SC8736 on the payment.

Staple payment to the front of this form in the indicated area.

F.

INTEREST AND PENALTY FOR FAILURE TO PAY TAX: The extension of time to file your South Carolina tax return

granted by this application DOES NOT extend the time for payment of tax. Any unpaid portion of the final tax due will bear

interest at the prevailing federal rates.This amount is computed from the original due date of the tax return to the date of

payment. In addition to the interest, a penalty at the rate of 0.5% per month to maximum of 25% must be added when the

amount remitted with the extension fails to reflect at least 90% of the tax due by April 15. The penalty will be imposed on the

difference between the amount remitted with the extension and the tax to be paid for the period.

Social Security Privacy Act Disclosure

It is mandatory that you provide your social security number on this tax form, if you are an individual. 42 U.S.C 405(c)(2)(C)(i) permits

a state to use an individual's social security number as means of identification in administration of any tax. SC Regulation 117-201

mandates that any person required to make a return to the SC Department of Revenue shall provide identifying numbers, as

prescribed, for securing proper identification. Your social security number is used for identification purposes.

The Family Privacy Protection Act

Under the Family Privacy Protection Act, the collection of personal information from citizens by the Department of Revenue is limited to

the information necessary for the Department to fulfill its statutory duties. In most instances, once this information is collected by the

Department, it is protected by law from public disclosure. In those situations where public disclosure is not prohibited, the Family

Privacy Protection Act prevents such information from being used by third parties for commercial solicitation purposes.

33902024

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2